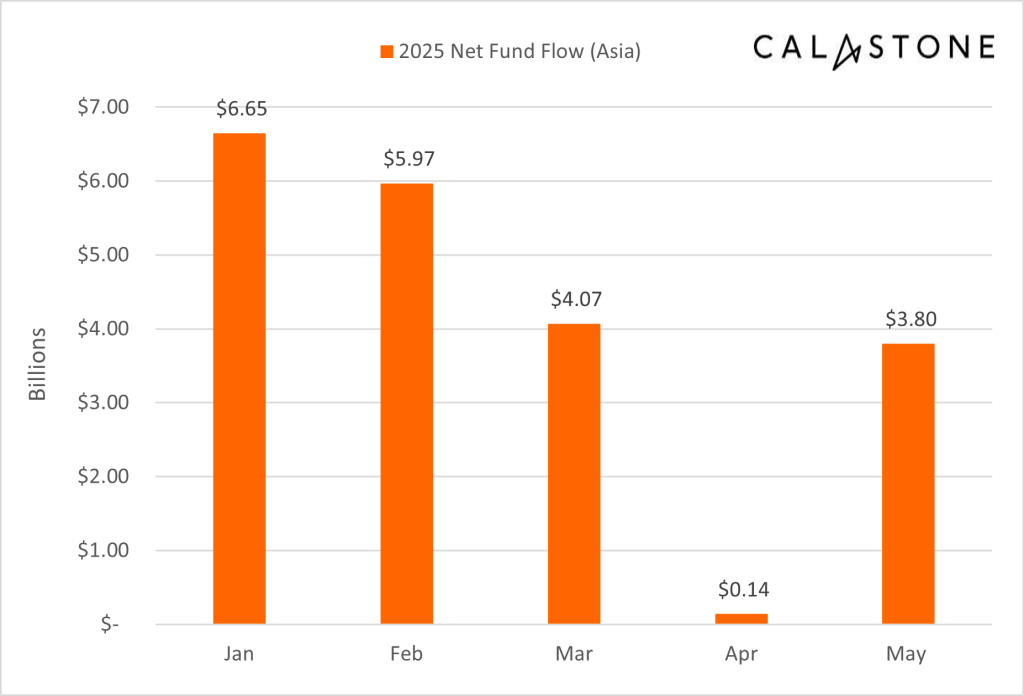

(Singapore, 12.06.2025)A sudden surge in geopolitical uncertainty triggered by the Trump administration’s sweeping tariffs rattled global markets in April, causing a sharp drop in fund inflows across Asia. According to the latest data from Calastone, the world’s largest global funds network, net inflows across all asset classes in Asia plummeted over 97% to just US$0.14 billion in April — a steep fall from the Q1 monthly average of US$5.56 billion.

The tariffs, which reignited trade tensions and sent equities tumbling, led to a stark reversal in investor sentiment. Equity funds, which had staged a strong comeback in early 2025, saw net redemptions of US$0.68 billion in April and US$0.14 billion in May, as investors pulled back amid heightened volatility and uncertainty.

Momentum Disrupted, Not Broken

Despite the turbulence, the region’s fund flow momentum remained resilient. Total net inflows from January to May reached US$20.63 billion, exceeding the US$18.06 billion recorded during the same period in 2024. The strong performance in the first quarter — led by US$6.65 billion in January and US$5.97 billion in February — helped cushion the blow from April’s pullback.

“The turbulence in April was a direct response to the sudden escalation in US trade tensions,” said Justin Christopher, Head of Asia at Calastone. “Faced with unpredictable policy signals and heightened market volatility, it was only rational for investors to pause and reassess. Yet the swift rebound in May across all asset classes highlights the resilience of Asia’s fund market and the agility of investors to adapt to rapidly shifting conditions.”

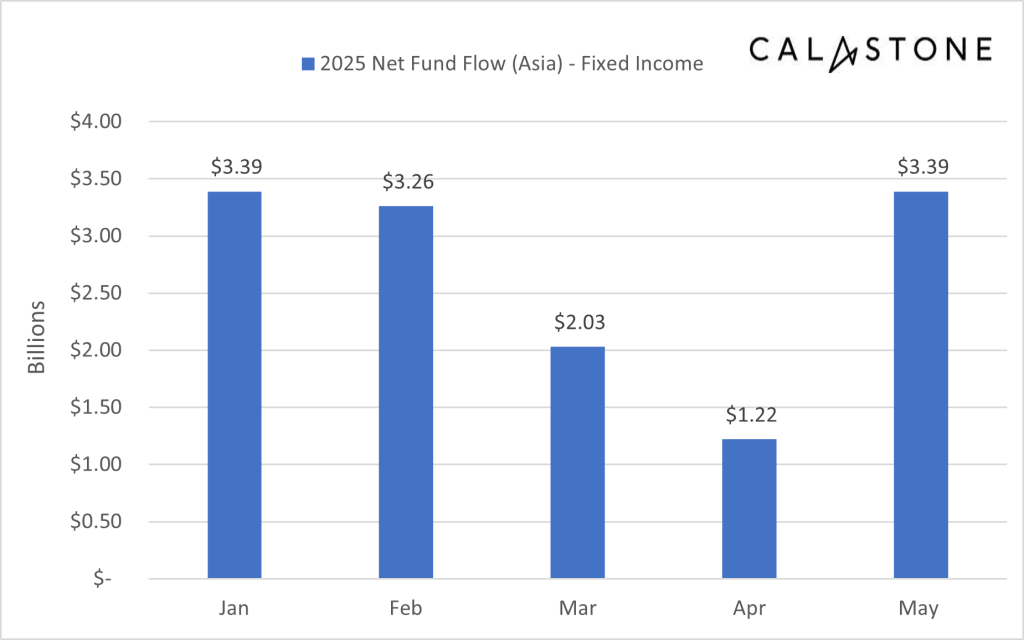

Fixed Income Emerges as Anchor in Storm

Fixed income funds remained the standout asset class, drawing US$13.29 billion in net inflows between January and May. Although April inflows slowed to US$1.22 billion — the lowest monthly total this year — the segment rebounded strongly in May with US$3.39 billion in new investments, matching January’s high.

The appeal of fixed income lies in its relative stability and yield predictability, particularly in times of uncertainty. A weakening US dollar and concerns over Washington’s confrontational posture toward the Federal Reserve briefly dampened enthusiasm in April, but investor confidence returned as trade rhetoric softened and bond markets stabilised.

Mixed asset funds, which had attracted steady demand in 2024 and saw net inflows of US$2.03 billion in Q1 2025, also experienced turbulence. April and May marked a reversal, with outflows of US$0.41 billion and US$0.14 billion respectively. Analysts attribute this to a strategic pivot by investors toward more focused exposure in safer asset classes — particularly fixed income.

Outlook: Fragile Confidence, But Underlying Strength

While April’s downturn underscores how geopolitical shocks can swiftly disrupt fund flow dynamics, the rapid recovery in May suggests investors remain fundamentally confident in the region’s long-term outlook. The adaptability of Asian fund markets — and their participants — continues to be a defining strength amid an increasingly complex global environment.