(Singapore, 07.08.2025)In a bold move that is set to shake up the technology industry, President Donald Trump announced a massive 100% tariff on imported semiconductors. The announcement, made from the Oval Office, is a core part of his strategy to bring manufacturing back to the United States. But there’s a big catch: companies that build their factories in the U.S. will be completely exempt from this new tax.

This “carrot and stick” approach was highlighted as Apple CEO Tim Cook stood by the President’s side to reveal a fresh $100 billion investment plan for U.S. manufacturing. This new pledge brings Apple’s total promised investment in the country to a staggering $600 billion over the next four years.

“We’re going to be putting a very large tariff on chips and semiconductors,” President Trump said to reporters. “But the good news for companies like Apple is, if you’re building in the United States… there will be no charge.” He explained that even if a company is just in the process of building a new factory and not yet producing a lot of chips, they will still be exempt.

This new policy is a huge victory for companies like Apple. The company and its CEO, Tim Cook, have been worried about new tariffs that could significantly increase the cost of their popular phones and computers. By committing to this massive new investment in the U.S., Apple can now avoid the 100% tariff on semiconductors, which are a vital part of every electronic device they make.

Apple’s $100 billion investment will boost its American Manufacturing Program. This program already works with U.S. companies like glassmaker Corning Inc., Applied Materials Inc., and Texas Instruments Inc. As part of this new plan, Corning will dedicate an entire factory in Kentucky to making glass for Apple products, which will increase its workforce in the state by 50%.

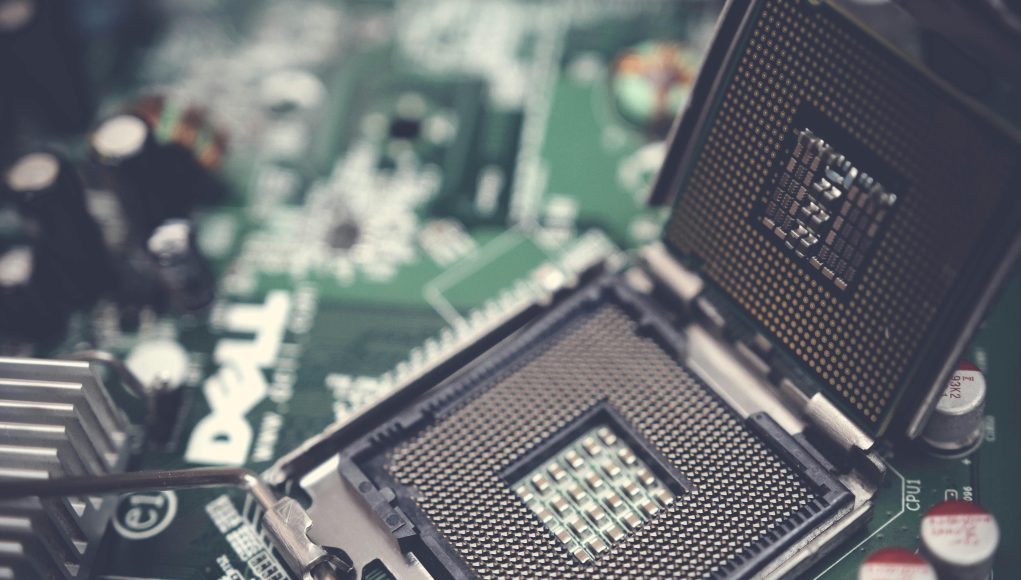

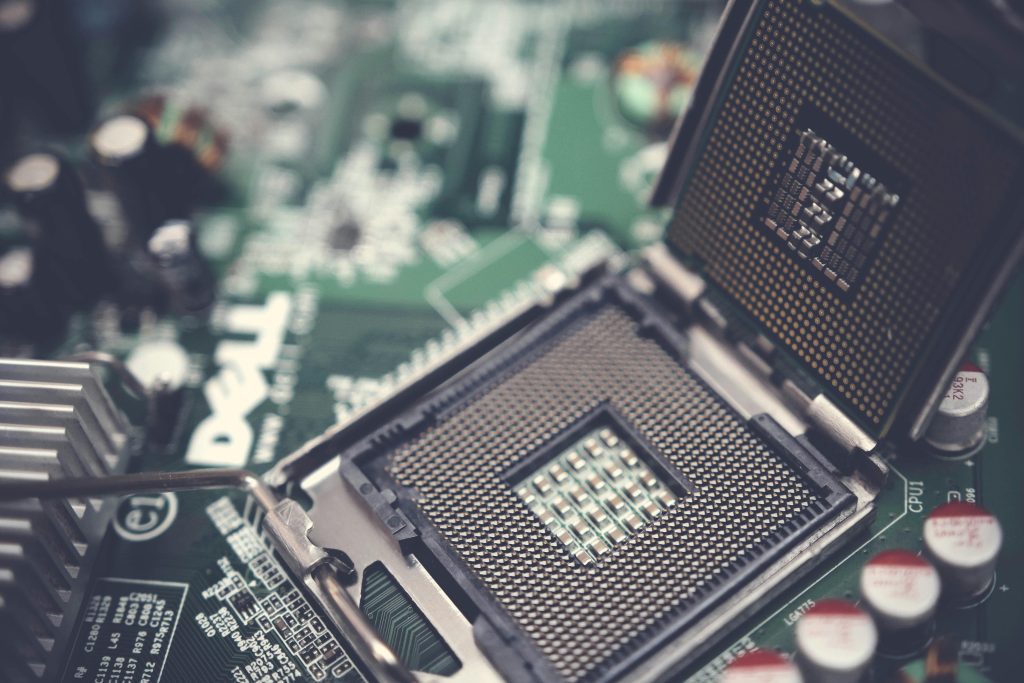

The new tariff policy could have a massive impact on the entire tech industry. The U.S. currently relies heavily on semiconductors made overseas, with most of the advanced chips coming from places like Taiwan. For years, lawmakers and security experts have warned that this reliance could make the U.S. vulnerable. President Trump’s new tariff is a powerful way to push for a change.

Many of the world’s largest chipmakers are already responding to this pressure. Big players like Taiwan Semiconductor Manufacturing Co. (TSMC), Samsung, Texas Instruments, and Intel have already announced major plans to build new factories in the U.S., often working directly with the White House. For these companies, the tariff exemption is a huge incentive to speed up their plans and invest even more in American production.

However, the situation is much more complicated for companies that design chips but don’t own the factories to make them. These “fabless” companies, like Nvidia and Advanced Micro Devices (AMD), rely on other companies like TSMC and Samsung to manufacture their chips. While Nvidia and AMD have also committed to spending large sums of money in the U.S., their supply chains are complex and global. They can’t simply move all of their production to the U.S. overnight. The new tariff could create a major challenge for them, as they may have to pay a steep tax on the chips they import, which could lead to much higher prices for their products.

This new tariff is part of a larger trend under the Trump administration. The President has been using tariffs as a tool to pressure companies and countries to change their trade practices. For example, he has also announced plans to place a 50% tariff on goods from India, a key production market for Apple’s iPhones. These tariffs are designed to reduce trade imbalances and encourage domestic production.

The announcement of Apple’s new investment and the tariff exemption is a perfect example of this strategy in action. The President has been pushing for companies to invest more in the U.S., and he has previously threatened to impose a 25% tariff on Apple if it didn’t move more of its manufacturing to the country. Tim Cook has been a frequent visitor to the White House and has actively sought to get exemptions from other tariffs for his company’s products.

While Apple’s new investment is substantial, it still doesn’t mean that every iPhone will be made in the U.S. Cook has said that final iPhone assembly “will be elsewhere for a while,” but he also emphasized that many key components are already made in America. President Trump, for his part, seemed satisfied with the new commitment, praising the Apple CEO’s plans. “He’s coming back. I mean, Apple’s coming back to America,” Trump said.

On Wall Street, investors reacted positively to the news. U.S. stock futures climbed, with shares in companies like Apple and Nvidia rising. While the new tariff creates some uncertainty, investors seemed to be more focused on the potential for an upcoming Federal Reserve rate cut and the strong investment commitments from major companies.

The new tariff policy and Apple’s response show a clear picture of the President’s economic vision. He is using both the threat of tariffs and the promise of exemptions to force companies to rethink their global strategies. This approach is designed to boost U.S. manufacturing and jobs, but it also creates a complex and uncertain environment for the global tech industry.