(Singapore, 17.10.2025)China’s economy is expected to have grown at its weakest pace in a year during the third quarter, despite a surge in exports that helped the country post a record trade surplus. The slowdown highlights deep structural challenges at home — from sluggish investment to weak consumer spending — that Beijing may seek to tackle at a key policy meeting next week.

According to a Bloomberg survey, gross domestic product likely expanded 4.7% year-on-year in the July–September period, down from 5.2% in the previous quarter. Data from the National Bureau of Statistics due Monday are expected to confirm that the world’s second-largest economy lost steam even as overseas demand for Chinese goods remained strong.

Exports Soar, But Domestic Weakness Drags

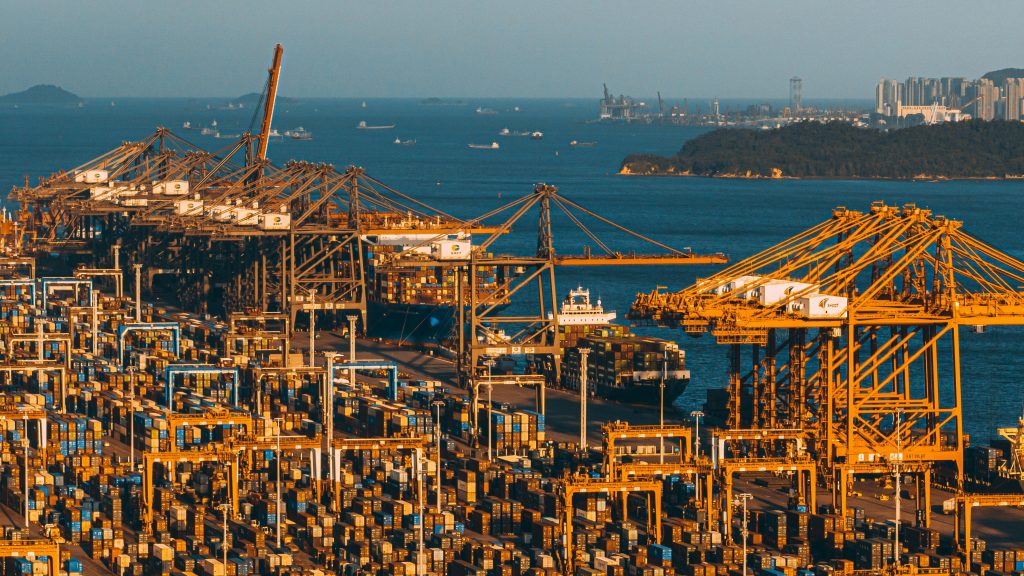

Exports have been a rare bright spot this year, with China’s trade surplus hitting a record $875 billion so far in 2025. Net exports accounted for 6.4% of GDP in the first half — the highest share in more than a decade — contributing nearly a third of total growth.

But that external strength has failed to offset weakness at home. Retail sales are estimated to have grown just 3% in September, while industrial production rose 5%, both marking the slowest pace this year. Property and fixed-asset investment are expected to have deteriorated further, extending months of decline.

“Despite the export boom, the domestic economy remains fragile,” said Michelle Lam and Wei Yao, economists at Société Générale SA. “With rising tariff risks and falling returns on traditional investment, boosting household consumption has become a top priority.”

Policymakers Turn to Consumption

Beijing’s focus is now shifting toward encouraging consumer spending. When Communist Party leaders gather next week for the Fourth Plenum, discussions are expected to center on economic priorities for the next five years, with greater emphasis on rebalancing growth away from exports and investment toward domestic demand.

Analysts believe officials may introduce a national consumption target — a move seen as signaling stronger policy commitment. Currently, household consumption accounts for around 40% of China’s GDP, well below the global average of 56% and far behind high-income economies, where consumption makes up nearly 60% of output.

Following U.S. President Donald Trump’s reelection and renewed trade tensions, Chinese policymakers have already pledged to expand spending on education, jobs, and social welfare. Still, concrete targets or stimulus measures have so far been limited.

“We expect technological self-sufficiency and national security to remain policy priorities, but modest social welfare reforms could also gain endorsement,” said Robin Xing, chief China economist at Morgan Stanley.

Nine Quarters of Deflation

Underneath headline growth, China faces mounting deflationary pressure. The country is on track for its ninth consecutive quarter of price declines, the longest stretch since economic reforms began in the late 1970s.

Falling prices have been driven by weak consumer demand and the prolonged property slump. Overcapacity in industries like electric vehicles and solar panels has intensified price competition, squeezing corporate profits.

While sales by China’s top 100 developers stabilized in September — with 253 billion yuan (S$45.9 billion) worth of new homes sold — the market remains only a fraction of its size before the property crisis erupted in 2020.

Fixed-asset investment, a key driver of China’s past growth, has stalled. It is projected to be flat year-on-year for the first nine months, weighed down by declining private sector confidence and tighter credit conditions.

Beijing has leaned heavily on local governments to support infrastructure spending. Authorities issued 11.5 trillion yuan in bonds in the first three quarters, a 60% jump from last year. Yet much of the money has reportedly gone toward debt repayment rather than new projects, limiting its impact on growth.

China’s budget deficit widened by 42% in the first eight months of the year as growth momentum weakened. Foreign investment also cooled, with new inbound FDI down nearly 13% between January and August — putting the country on track for a third straight annual decline.

Exports Offer Temporary Relief

For now, foreign demand remains China’s biggest cushion. Strong shipments of electric vehicles, machinery, and electronics have boosted export revenue and helped Beijing weather U.S. tariffs and geopolitical uncertainty.

The export boom also gives China a stronger bargaining position in its trade talks with Washington. As U.S.-China tensions escalate, Chinese manufacturers have increasingly diversified their markets, reducing dependence on American buyers.

However, economists warn that exports alone cannot sustain growth if domestic demand remains weak. Persistent deflation and a soft job market risk undermining consumer confidence, while the property downturn continues to drag on household wealth.

Despite recent weakness, few analysts expect Beijing to roll out large-scale stimulus in the near term. The economy’s solid performance earlier in the year has kept full-year growth on track to meet the official target of around 5%.

Late last month, the government unveiled a 500 billion yuan “new financing policy tool” aimed at boosting investment through quasi-fiscal channels. Economists at Citigroup said the measure could help stabilize infrastructure spending and prevent a sharper downturn by year-end.

“We don’t expect fixed-asset investment growth to drop further,” Citi’s Yu Xiangrong wrote. “The new financing tool should provide some support in the fourth quarter.”

Still, with exports likely to cool and household consumption lagging, China’s path to balanced and sustainable growth remains challenging. The upcoming Party meeting will be closely watched for signals of how far leaders are willing to go in reorienting the economy — from one powered by factories and construction to one driven by consumers.