(Singapore, 08.08.2025) In a stunning and unprecedented intervention that has sent shockwaves through the corporate and political worlds, President Donald Trump has publicly demanded the immediate resignation of Intel’s new CEO, Lip-Bu Tan.

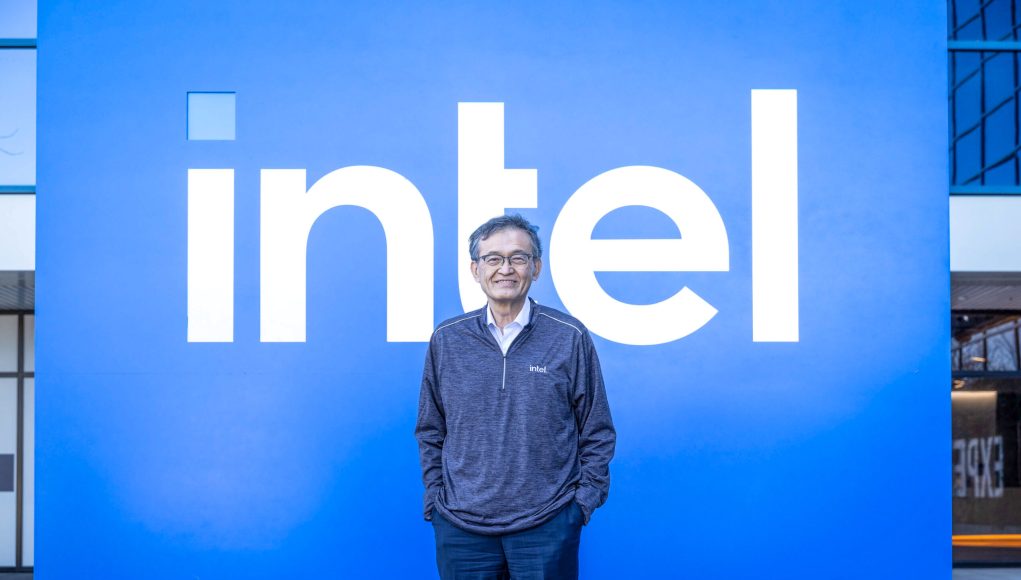

The Malaysian-born executive, a revered veteran of the semiconductor industry, is accused by Trump of being “highly CONFLICTED” due to his extensive and deep-seated business dealings in China. Trump asserts that these ties pose an unacceptable and grave risk to American national and economic security.

This extraordinary action by a prominent political figure in the leadership of a private company has ignited a geopolitical firestorm, placing the already struggling American semiconductor giant at the very heart of the escalating rivalry between Washington and Beijing.

For a company that is not just a commercial enterprise but a cornerstone of U.S. national security and technological strategy, the implications of this controversy are immense and far-reaching.

The Slow Burn: A Chronicle of Accusations

The pressure on Lip-Bu Tan has been building for months, a slow-burning fuse lit by a series of investigative reports and political actions. The spark that ignited this week’s explosion was a detailed Reuters investigation published in April.

The report meticulously outlined how Tan, a veteran venture capitalist with deep roots in Silicon Valley’s investment community, had invested at least $200 million in hundreds of Chinese technology and manufacturing companies over more than a decade.

The investigation, which reviewed numerous Chinese and U.S. corporate filings, found that these investments were made through his venture capital firm, Walden International, and a complex web of other holding companies.

Crucially, the report highlighted a web of connections that included investments in firms allegedly linked to the People’s Liberation Army (PLA). This finding is particularly damning for Intel, a company that is not just a commercial giant but a key partner in the U.S. defense ecosystem. Intel has secured a massive $8 billion in subsidies under the 2022 CHIPS Act to build new fabrication plants in states like Ohio, a cornerstone of the U.S. government’s strategy to re-establish domestic dominance in chip manufacturing. For critics, the idea that a CEO with such profound financial ties to a geopolitical adversary could lead a company so vital to U.S. security is simply untenable.

The Cadence Connection

The controversy was further amplified just days before Trump’s public outburst when Republican Senator Tom Cotton of Arkansas sent a pointed and critical letter to Intel’s board chairman, Frank Yeary. The letter, first reported by Reuters, expressed “concern about the security and integrity of Intel’s operations and its potential impact on U.S. national security.” Cotton questioned whether Intel’s board had properly vetted Tan and if they were fully aware of his extensive ties to Chinese firms.

Cotton’s letter also brought a second layer of controversy to Tan’s doorstep, connecting him to a recent criminal case involving his former company, Cadence Design. From 2008 through 2021, Tan served as the CEO of Cadence, a company that makes software used to design chips.

During his tenure, the company sold its products to a Chinese military university known to be involved in simulating nuclear explosions. Last month, Cadence agreed to plead guilty to the charges and pay a hefty fine of over $140 million to resolve the U.S. government’s case.

Cotton’s letter demanded to know if Intel’s board was aware of the subpoenas and investigations into Cadence while Tan was in charge, and what measures were taken to address these concerns before he was hired as CEO. This line of inquiry raises serious questions about Intel’s due diligence process and whether the company fully considered the political and national security ramifications of its choice for CEO.

Tan’s Response and the Market Reaction

The accusations have created a difficult and precarious position for Lip-Bu Tan. In a public statement, he has vehemently affirmed his unwavering commitment to U.S. national and economic security, stating that his reputation was built on “trust” and “doing what I say I’ll do, and doing it the right way.” He added that the company is “engaging with the Administration to address the matters that have been raised and ensure they have the facts.”

A source familiar with the matter told Reuters that Tan has divested from his Chinese holdings, but the extent of these divestitures remains unclear, as Chinese corporate databases reviewed by Reuters still listed many of his investments as current at the time of the initial report.

For investors and industry analysts, the situation is a high-stakes puzzle with no easy answers. On one hand, many agree with Phil Blancato, CEO of Ladenburg Thalmann Asset Management, who said, “You don’t want American presidents dictating who runs companies, but certainly his opinion has merit and weight.”

Others, like Bernstein analyst Stacy Rasgon, noted that Tan’s China ties are creating “an increasingly bad look,” especially given the current political climate. The core of the problem is that Intel is no ordinary company. It is a vital cog in the U.S. national security apparatus, with a $3 billion contract to make chips for the Department of Defense and a leading role in other defense initiatives. This unique position means that its leadership is subject to a level of scrutiny that other companies might not face.

A Company in a Precarious Position

This political firestorm is unfolding at a particularly vulnerable moment for Intel. The company has been struggling for years, losing its manufacturing edge to Taiwanese rival TSMC and falling far behind Nvidia in the race for the lucrative artificial intelligence chip market. It has also seen its market share in its traditional strongholds—data centers and personal computers—eroded by rival AMD.

Last year, the board fired then-CEO Pat Gelsinger well before he could complete his ambitious turnaround plan, bringing in Tan to lead the company out of the crisis, betting on his deep industry knowledge and track record as a successful investor.

However, Tan’s turnaround strategy has been fraught with its own challenges. He has largely abandoned his predecessor’s roadmap, opting for a more aggressive approach that includes significant workforce reductions and a slowdown in planned manufacturing plants. The production process that Intel hoped would restore its technological lead is also reportedly facing quality hurdles. Furthermore, the construction of a flagship factory in Ohio, a centerpiece of its domestic manufacturing push, has been delayed, with completion now expected sometime between 2030 and 2031.

The public call for Tan’s resignation, therefore, comes not just as a political attack but as an added layer of turmoil for a company already in a precarious position. Intel’s stock closed down 3% on Thursday, reflecting the uncertainty and unease among investors. While Tan has the public support of his board, the pressure from President Trump and a key senator is a powerful force that cannot be easily dismissed.

The saga of Lip-Bu Tan and Intel is a stark reminder of the new realities of global business, where the line between corporate leadership, economic policy, and national security is becoming increasingly blurred. The resolution of this crisis will not only determine the future of a storied American company but may also set a new precedent for how political powers can influence the boardroom in a world defined by geopolitical competition.