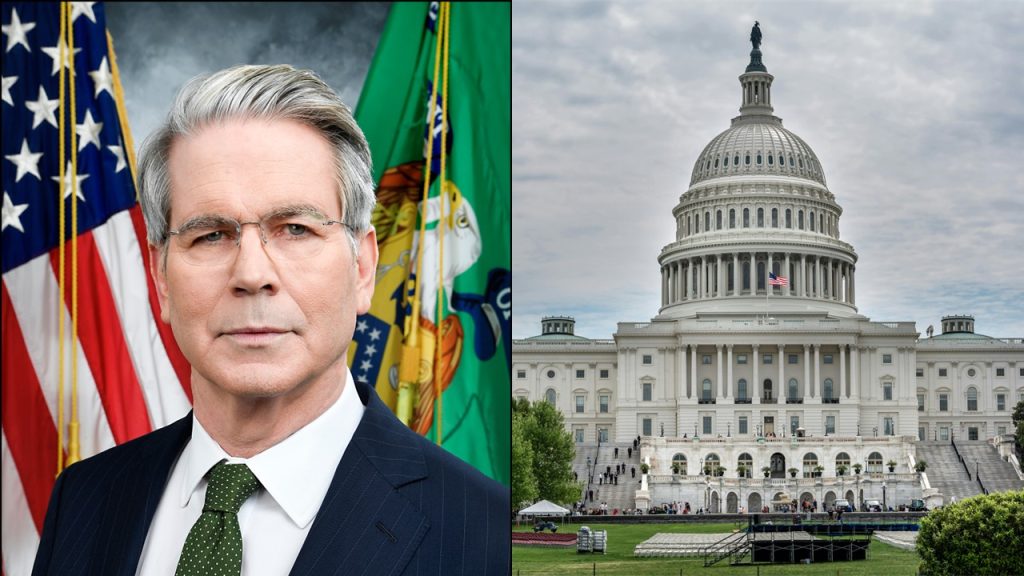

(Singapore, 16.10.2025)The ongoing U.S. government shutdown is dealing a heavy blow to the economy, costing about $15 billion a day in lost output, Treasury Secretary Scott Bessent said on Wednesday, as he urged Democrats to help Republicans end the impasse.

Speaking at a press briefing in Washington, Bessent said the two-week-old shutdown is beginning to “cut into the muscle” of the economy, warning that the longer it continues, the greater the risk to jobs and investment confidence.

“We believe the shutdown may start costing the U.S. economy up to $15 billion a day,” Bessent said. “The only thing slowing us down here is this government shutdown.”

The political standoff has forced hundreds of thousands of federal workers to stay home and delayed a wide range of government services, from loan processing to research grants. Economists have cautioned that if the shutdown stretches into November, it could shave half a percentage point off fourth-quarter growth.

Despite the disruption, Bessent insisted that the wave of private-sector investment — particularly in artificial intelligence, manufacturing, and clean energy — remains strong and sustainable.

“There is pent-up demand, but President Trump has unleashed this boom with his policies,” he said at a CNBC event held alongside the International Monetary Fund and World Bank annual meetings. “This could be a period like the late 1800s when railroads transformed the economy, or the 1990s when the internet did.”

Bessent said that Republican tax incentives and tariffs have helped fuel a new industrial expansion and that he sees room for further growth if Washington can restore normal government operations.

Still, analysts warn that a prolonged shutdown could delay federal permits, slow infrastructure rollouts, and dent business confidence — key ingredients in the very boom Bessent hopes to sustain.

Deficit Shrinks Modestly

Bessent also revealed that the U.S. budget deficit for fiscal 2025, which ended September 30, was smaller than the previous year’s $1.83 trillion gap. While he did not provide a figure, he said the deficit-to-GDP ratio could fall into the 3% range in the coming years if the economy keeps expanding.

“The important number is the deficit relative to GDP — and right now it still has a five in front of it,” Bessent said. “But it’s possible to bring it down if we grow more and spend less.”

Preliminary estimates from the Congressional Budget Office suggest the 2025 deficit declined slightly to around $1.82 trillion, helped by an additional $118 billion in tariff revenue.

Bessent said that the next step for the administration is to “keep growth strong and constrain spending,” signaling that fiscal discipline will be part of the Trump administration’s broader economic agenda going into 2026.

Preparing to Pick the Next Fed Chair

In a separate discussion, Bessent said he plans to present three or four candidates to President Donald Trump for the next Federal Reserve chair after the Thanksgiving holiday, setting the stage for one of the most consequential economic appointments of Trump’s second term.

The shortlist — narrowed from 11 to five names — is expected to include some of Trump’s existing Fed appointees. The move could give Trump an opportunity to exert greater influence over a central bank that has long prized its independence.

“We’ll present the president with three or four candidates in December for him to interview,” Bessent said. “He’ll take input from dozens, even hundreds of people, before making a decision.”

Current Fed Chair Jerome Powell’s term ends in May. Trump, who appointed Powell in 2018, has frequently criticized him for keeping interest rates “too high.”

The Fed cut rates by a quarter-point in September to a range of 4.00%–4.25% amid concerns about a slowing job market, but Trump has argued that rates should be closer to 1%.

Bessent declined to say whether rate-cutting bias would be a key factor in choosing Powell’s successor. “One of the criteria is to have an open mind,” he said.

Process Could Stretch Into 2026

The selection process could extend well into next year, given that any nominee must be confirmed by the U.S. Senate.

Among the reported finalists are Fed Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller, both appointed by Trump. Others said to be under consideration include National Economic Council Chair Kevin Hassett, former Fed Governor Kevin Warsh, and Rick Rieder, BlackRock’s chief investment officer for fixed income.

Complicating matters is an ongoing legal battle over Fed Governor Lisa Cook, whom Trump tried to remove in August over unproven allegations of mortgage fraud — an unprecedented move now headed to the Supreme Court in January.

As Washington grapples with political gridlock and leadership transitions, Bessent remains optimistic that the economy’s momentum will endure if policymakers can keep disruptions in check.