(Singapore, 18.08.2025)A weekend summit between U.S. President Donald Trump and Russian President Vladimir Putin in Alaska may have bypassed a ceasefire, but it’s already sending shockwaves through global markets. The meeting, which ended with Trump calling for a rapid peace deal that could involve Ukraine ceding land, has set the stage for a major geopolitical shift. Investors are now rushing to figure out what this new reality means for their portfolios.

So, why does this matter to the average investor? Because this isn’t just a political story; it’s a financial one, with huge implications for everything from defense budgets and oil prices to the stability of sovereign debt. The ripples from this summit are already being felt, signaling that the rules of the global financial game may be about to change.

The Diplomatic Bind: Zelenskiy’s Impossible Choice

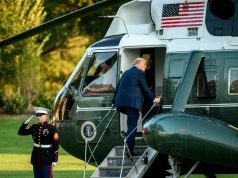

The market’s reaction is a direct reflection of the diplomatic pressure now bearing down on Ukrainian President Volodymyr Zelenskiy. Fresh off the Alaska summit, Trump has left Zelenskiy with an impossible choice: risk Trump’s wrath and potentially a halt to military aid, or accept a quick peace deal that could involve ceding territory for what many fear are vague security guarantees.

This existential dilemma is compounded by the memory of Zelenskiy’s last visit to Washington, which ended in a bitter public exchange and a brief halt in military support. This time, the stakes are even higher, but Zelenskiy isn’t going it alone.

Europe to Join the Washington Talks

In a powerful display of solidarity, leaders from Germany, the UK, and France are joining Zelenskiy in Washington today (Aug 18, 2025) for the talks. This strategic move aims to present a united front and prevent Ukraine from being pressured into a peace deal that favors Russia, a lesson learned from the contentious February meeting. European officials are hoping that their collective presence will deter a repeat of the difficult previous encounter.

The Defence Stock Bonanza

For months, savvy investors have been placing a bullish bet on the idea that Europe would have to take its own defense more seriously. The result has been a massive, supercharged rally in European aerospace and defense stocks. Since February 2022, companies like Italy’s Leonardo have seen their shares skyrocket by more than 600%, while Germany’s Rheinmetall has witnessed a staggering 1,500% surge.

This unprecedented momentum is only expected to continue. The talks in Alaska and the clear signal from the U.S. that it may be pulling back its support for Kyiv have put European leaders on high alert. As Berenberg Chief Economist Holger Schmieding noted, “Trump seems inclined to reduce or even end U.S. support for Ukraine. Putin got him interested in business deals.” The logical consequence, as Schmieding argues, is that “Europe will have to spend a lot more for its own defense.”

For the defense sector, this isn’t just a short-term boost; it’s a fundamental shift in business. After decades of relying on American military might, European nations are now facing the reality of a new geopolitical landscape. This means massive new contracts for local defense manufacturers, long-term government spending commitments, and a sustained growth narrative that makes these companies incredibly attractive to investors. The message is clear: more spending is coming, and that means more business for these defense giants.

The Arctic Alliance: A Bearish Oil Outlook

Beyond defense, the other major market disruption comes from a potential business alliance in the Arctic. The meeting sparked concerns that the U.S. may move closer to Russia in a bid to exploit vast, untapped Arctic energy resources. This region is estimated to hold a whopping 15% of the world’s undiscovered oil and 30% of its undiscovered natural gas, making it a potential goldmine.

This possibility is a game-changer for the energy market. A new flood of oil and gas from a U.S.-Russia partnership could create a “deep energy bear market,” pushing prices down dramatically and completely reshaping the global energy supply chain.

As Bank of America strategist Michael Hartnett highlighted, while Brent crude has already dropped slightly to near $66 a barrel, the current price doesn’t fully account for the market fallout of this massive energy-focused alliance. Trump has made his desire for lower energy prices for U.S. consumers known, adding fuel to this potential fire and creating a bearish outlook for oil producers everywhere.

Ukraine’s Bonds Under Pressure

A key indicator of investor confidence is already flashing red, signaling the grim market outlook for Ukraine. The country’s government bonds, which act as a key barometer of investor sentiment, initially rallied when news of the summit emerged. However, they have now stalled at a still-distressed value of 55 cents per dollar.

According to Aegon Asset Management’s head of emerging market debt, Jeff Grills, the bonds are likely to get “a bit weaker following the recent strength as the mood seems to favour Russia.”

This is a clear sign that the market is losing confidence in a favorable outcome for Kyiv, bracing for a scenario where Ukraine is forced to make significant concessions. A country’s bonds are essentially a measure of its financial health and stability; when they trade at such a distressed value, it signals to the market that a default or a restructuring is a very real possibility.

What’s at Stake?

All eyes are now on the Washington talks. The outcome of these discussions will determine the next moves for global markets. Will Trump’s push for a peace deal lead to a disruptive U.S.-Russia energy alliance? Will it accelerate European defense spending to unprecedented levels? And will it leave Ukraine in a more precarious financial and geopolitical position?

The answer to these questions will decide whether the defense rally continues, the oil market crashes, and Ukrainian bonds plunge further. Investors are no longer just watching the battlefield; they’re watching the high-stakes diplomatic chess game being played out in Washington, knowing that every move could mean billions of dollars gained or lost.