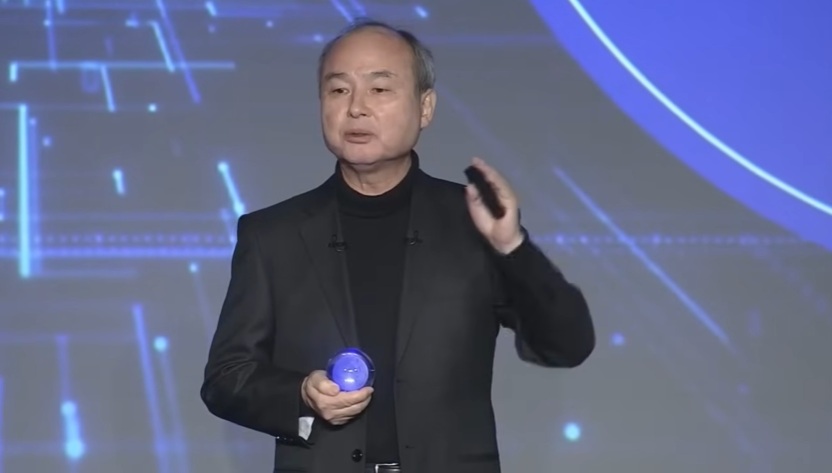

(Photo: Screenshot from SoftBank Group’s official YouTube channel)

(Singapore, 30.10.2025)Masayoshi Son, the founder of SoftBank Group Corp. and the driving force behind some of the world’s most ambitious technology investments, has reclaimed the title of Japan’s richest person, a position he last held more than a decade ago.

According to the Bloomberg Billionaires Index, Son’s net worth has surged 248% this year to US$55.1 billion, overtaking Uniqlo founder Tadashi Yanai, whose fortune now trails just behind. The sharp rise underscores how the global artificial intelligence (AI) boom has reshaped wealth and power across industries and Son, 68, is once again at the heart of that transformation.

Son’s soaring fortune mirrors the rally in SoftBank Group Corp. shares, which have climbed sharply this year. The billionaire owns roughly a third of the company, whose vast portfolio spans chip design, robotics, telecommunications, and a growing array of AI ventures.

Long known for his bold and often risky investment style, Son has been on an aggressive push this year to position SoftBank as a central player in the global AI infrastructure race. The company has poured billions into data centers, semiconductor ventures, and startups building the digital backbone of artificial intelligence.

The latest catalyst came earlier this year when Son pledged US$100 billion in new US investments, aligning with American economic priorities during President Donald Trump’s visit to Tokyo. On Wednesday, SoftBank shares climbed again after being listed among companies set to participate in major AI-related projects in the US.

Mega Deals in the Making

At the core of Son’s ambitions lies a planned US$30 billion investment in OpenAI, the creator of ChatGPT. SoftBank is also part of a US$500 billion consortium alongside Oracle Corp. and Abu Dhabi’s MGX to develop AI data centers and related infrastructure across the United States.

And Son is not stopping there. He has reportedly held talks with Taiwan Semiconductor Manufacturing Co. (TSMC) on a trillion-dollar industrial complex in Arizona focused on AI and robotics, a project that could redefine the global tech supply chain.

SoftBank itself has been on a buying spree, acquiring ABB Ltd.’s robotics division for US$5.4 billion, investing US$2 billion in Intel Corp., and expanding its stakes in Nvidia and TSMC. These moves have turned SoftBank’s stock into a proxy for investors betting on the AI infrastructure boom.

“Everything is breaking the right way for SoftBank at the moment,” said Kirk Boodry, an analyst at Bloomberg Intelligence. “Everything AI-related is going up, and the OpenAI connection has been a key driver.”

OpenAI’s Trillion-Dollar Target

Son’s resurgence also coincides with the mounting excitement around OpenAI itself. According to Reuters, the San Francisco-based AI startup is preparing to file for an initial public offering (IPO) as soon as 2026, potentially valuing the company at US$1 trillion — one of the largest listings in corporate history.

OpenAI recently completed a corporate restructuring that could enable such a move. While the company has not confirmed a timeline, CEO Sam Altman has acknowledged its massive capital requirements, revealing that OpenAI expects to spend US$1.4 trillion on AI infrastructure.

Altman said an IPO is “the most realistic path” to raise that capital, with discussions reportedly underway for a US$60 billion public offering.

“An IPO is not our focus,” the company said in a statement. “We are building a durable business and advancing our mission so everyone benefits from AGI.”

Even so, a trillion-dollar valuation would send ripples through global markets and significantly boost SoftBank’s portfolio if Son’s proposed investment materializes.

From Setbacks to Second Acts

For Son, this latest triumph marks a stunning comeback. At the height of the dot-com bubble, his net worth once grew by US$10 billion a week, briefly making him the world’s richest person — a title that evaporated within days when tech stocks collapsed.

“Somehow, I survived,” Son said in a 2017 interview. “At that time, I said, now is the time to go to the next stage — the mobile internet.”

He followed through. Over the next two decades, early bets on Alibaba Group and exclusive Apple iPhone distribution rights in Japan powered SoftBank’s meteoric rise. But more recently, his Vision Fund suffered major losses after China’s regulatory crackdown on tech companies, wiping billions off his paper wealth.

Now, the AI boom has given Son a new windfall and perhaps his strongest validation yet.

A New Chapter for Japan’s Tech Titan

Born in 1957 in Kyushu, Son was raised in an ethnic Korean family before moving to the United States as a teenager. While studying, he developed an electronic dictionary that he later sold to Sharp Corp. for US$1 million, providing the seed capital for his early ventures.

He founded SoftBank in 1981 as a software distributor, which over the next four decades grew into a sprawling conglomerate spanning telecommunications, e-commerce, fintech, and venture capital.

Today, Son’s ambitions extend far beyond Japan. With a long-term vision of achieving artificial general intelligence (AGI) — technology capable of outperforming humans in most tasks — Son wants SoftBank to play a defining role in shaping the next phase of the digital economy.

Still, some analysts warn that valuations across the AI sector — from Nvidia to OpenAI — are inflated, driven by overlapping investments and speculative momentum. But for now, Son’s timing looks impeccable.

After years of volatility and near-misses, Masayoshi Son is once again on top — Japan’s richest man, and perhaps its boldest dreamer.