(Singapore, 28.07.2025) Professor William Chen, a Singapore expert in food biotechnology, pointed out that for Chinese food products to capture the Singapore market, they must undergo a gradual process of acceptance by consumers. Take the mala flavor for example — a decade ago, it was relatively unknown to the locals, but today it has become an ordinary favorite to many.

However, for Chinese food products to successfully land in Singapore, companies must first have a deep understanding of local consumer tastes. Basing on this, they then innovate to align the products more closely with local palate while ensuring food safety standards are met.

Professor Chen emphasized that food safety is a strength rather than a barrier to food business in Singapore. As long as Chinese food companies can ensure their products are safe for consumption, meet local tastes, and comply with Singapore’s and regional market standards, they can leverage Singapore as a regional hub to expand their reach to other Southeast Asian countries.

These insights were shared by Prof Chen, director of the Food Science and Technology Programme at Nanyang Technological University (NTU), during the “New Synergies between China Agriculture & Singapore Agri-Food Future” forum held on 25 July. The event was co-organized by China’s Zixin Group and the Chinese Pinnacle Club, a business platform under Fortune Times.

Professor Chen: Translating Existing R&D Capabilities into New Agricultural Technologies

Prof Chen, who also serves as the director of Singapore Future Ready Food Safety Hub, noted that Singapore’s food safety standards have always been stringent. Any incident of food poisoning would become national news, which is why it rarely happens in Singapore.

He added that the Singapore Food Agency (SFA) is also keeping pace with the times by actively positioning Singapore as a future hub for food safety, whose goal is to perpetuate food safety.

“Future food safety isn’t just about whether production processes are contaminated; it also involves assessing the potential impact of novel foods on the human digestive system,” Professor Chen stressed. “These are research projects on which we are collaborating with the World Health Organization. Singapore is at the global forefront, delving deeply into every dimension of food safety.” Prof Chen emphasized.

Other than food safety, Prof Chen cited Singapore’s strategic approach to food security, which relies on three pillars: developing its own urban agriculture, diversifying sourcing, and forging collaborations abroad to expand its food reserves — such as operating farms in Brunei and partnering with China on the Sino-Singapore Jilin Food Zone.

To overcome its “production limitations” and enhance food security, Singapore launched the “30 by 30” vision in 2019, aiming to achieve 30% self-sufficiency in food production by 2030. This reflects the government’s determination to strengthen food supply security and nurture local agriculture.

However, the reality remains challenging. According to the latest data from the SFA, local production of vegetables and seafood in 2024 fell far short of targets.

While Singapore’s current limitations make the goal seem unrealistic, productivity has improved — egg farms have increased output by 12.8%, while vegetable and seafood yields per unit of land have risen by 1.8% and 5.4% respectively. “Singapore not only has three local egg farms, but locally grown produce is also much cheaper than imports from countries like Australia — sometimes up to four times lower. We should have confidence in the government’s blueprint,” Prof Chen remarked.

Singapore boasts the world’s most extensive food import network, sourcing from 187 countries and regions, and has signed 28 free trade agreements globally. These are to Singapore’s advantage. “It’s hard to imagine these countries collectively imposing an embargo on Singapore, so food supply is fundamentally stable.

However, concerns about climate change impacting food prices remain. From a risk perspective, we should be ready to support locally produced foods like vegetables,” Prof Chen added.

He also discussed how advancements in agricultural technology can be derived from existing non-food R&D capabilities. For instance, Singapore is already a hub for biomedical research. By leveraging the local scientific expertise to extend related technologies to development and use of agricultural resources, innovation in agriculture can be accelerated.

He cited vaccine production technologies as an example, noting their potential to be adapted to agriculture. “This means we don’t necessarily have to start from scratch or take a long time,” he explained. “The real challenges lie in the high costs and the still-low market acceptance.”

Elaine Foo: Good Governance is a Key Factor in ESG Investing

In the panel discussion, Elaine Foo, CEO of New Dimensions Capital, shared her perspective on agriculture from an investor’s standpoint. With the rising trend of ESG (Environmental, Social, and Governance) requirements, she noted that compliance with ESG standards is always at the back of the mind of the investment community.

Her firm seeks out ESG-compliant companies, conducting thorough due diligence to assess factors like E- no environmental pollution etc., S-no child labour or trafficking, and G – a good management governance to ensure policies are in place to ensure they comply to ESG standards. Among these, the character of a corporate governance is the most critical, as it determines whether the other two considerations are upheld.

She shared a case study of a biotech startup in Singapore that uses AI to produce organic food flavor enhancers, which boosted product competitiveness in the market. The team consists of ambitious young entrepreneurs who brought idea from Silicon Valley to Singapore.

Foo also touched on investing in agricultural projects through venture capital and private equity (VC/PE), such as farmland real estate investment trusts (REITs) that generate cash flow. For example, tailored financing for startups can help them raise funds for farmland.

New Dimensions Capital is a firm dedicated to providing comprehensive asset management services to high-net-worth families and institutional investors. “I believe agriculture is an ESG-related industry, and we aim to increase investments in this sector,” Foo said. She also hopes to raise public awareness and education about agriculture to dispel the notion that it is inherently a “high-risk” investment field.

Liang Chengwang: Sweet Potatoes as a Lever for Singapore’s Agricultural Technology Development

Liang Chengwang, Executive Chairman and CEO of Zixin Group, delivered the keynote speech of the event. Founded in 2009 in Liancheng, Fujian, Zixin Group focuses on building a comprehensive sweet potato industry chain, covering cultivation, processing, R&D, sales, and byproduct recycling. The group has replicated this model in rural economies across China, including collaborations in Hainan and Henan.

In 2016, Zixin Group successfully listed on the Singapore Exchange’s Catalist board (Stock Code: 42W), becoming the world’s first listed company primarily engaged in the sweet potato industry. Last year’s financial report showed Zixin’s sweet potato business revenue reached approximately RMB 318 million (about SGD 57 million), a 45% year-on-year increase.

Sweet potatoes are rich in dietary fiber, aligning with Singaporean consumers’ demand for low-calorie, functional foods. In fact, rising health consciousness is driving the Asia-Pacific sweet potato market to grow at an annual rate of 6.4%.

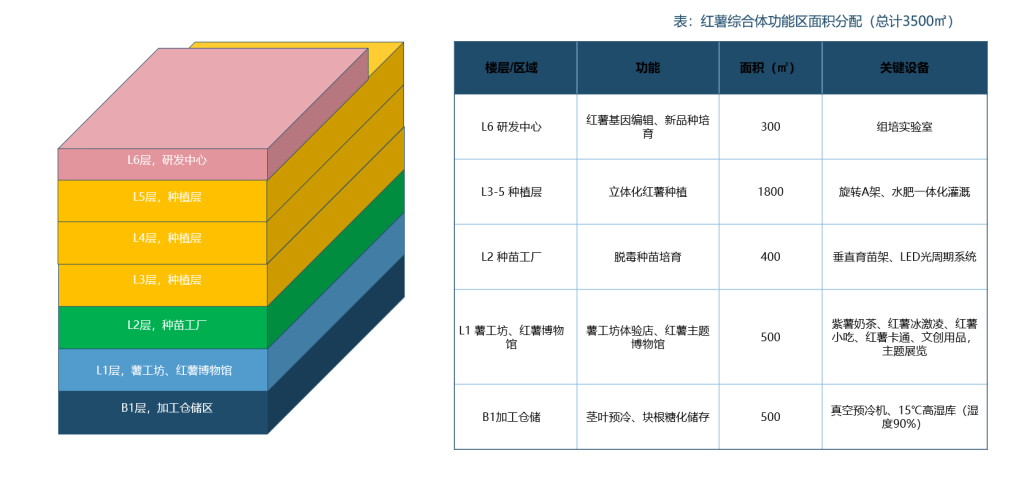

Liang shared his insights into high-tech sweet potato cultivation. He noted that while Singapore’s land area is limited, this does not constrain sweet potato farming, as they can be grown on rooftops or using tiered hydroponic systems. Additionally, Singapore’s government-funded smart farming systems, such as those developed by Temasek Polytechnic to optimize light and nutrient distribution, are highlights of the local agricultural sector.

Zixin Group is already innovating in Singapore putting out products like premium sweet potato snacks, purple sweet potato powder, and functional foods, while expanding its high-tech production lines by using vacuum low-temperature dehydration technology on chips, powder, and steamed sweet potatoes.

Its Singapore subsidiary has also developed probiotic-fermented sweet potato feed in collaboration with the Fujian Academy of Agricultural Sciences, turning agricultural waste into chicken feed.

Liang further proposed the “Singapore-China Supply Chain” concept, where sweet potatoes are cultivated and processed in both China and Singapore, with Singapore serving as a hub for quality certification, packaging, innovation, and regional distribution. “Sweet potatoes can become a lever for Singapore’s agricultural technology development and a local health food, reducing its reliance on imported foods and strengthening the resilience of Singapore’s food supply chain.”