On May 2025, Alfa Bank was honoured with Fortune Times’ Leader in FinTech Solutions Award 2025 for AI Innovation. We have approached the bank’s management to find out what specific technologies the bank uses to improve its business processes.

Russian banks and new technologies

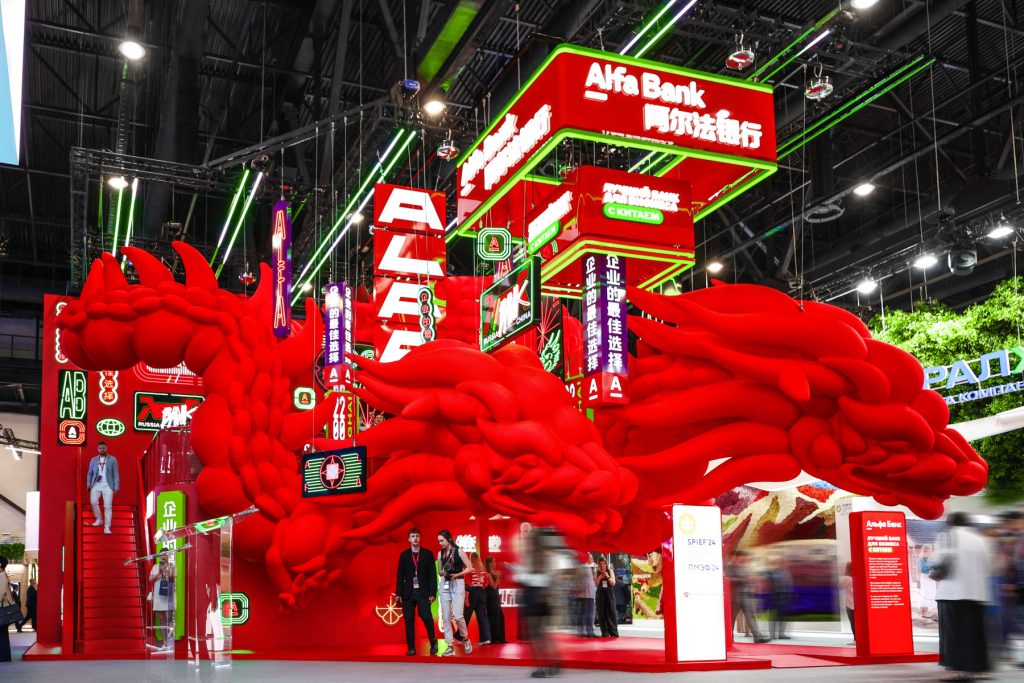

In an era marked by rapid digital transformation, Alfa Bank has distinguished itself with the “Leader in FinTech Solutions” Award, a testament to its innovative strategies. This prestigious recognition not only celebrates Alfa Bank’s continuous advancements and investments in financial technology but also underscores its role as a leader in the global banking sector.

Alfa-Bank has been the first in Russia to implement the Chinese “thinking” AI model DeepSeek R1 in a matter of hours. Right now, it is a powerful neural network with a capacity surpassing that of ChatGPT and Gemini. The model shook up the American stock market just with its release and astonished the Silicon Valley with the advanced artificial intelligence models.

AI assistants for customers and employees

The bank also said that it uses generative AI to improve the quality, security and speed to market of its digital products, and the integration of the new “reasoning” LLM will allow it to implement advanced solutions for customers even more efficiently. LLMs speed up data processing, enhance analytics, allow for better personalization of services, and create next-generation AI assistants.

We asked what other AI innovations are employed in the Russian banking sector. Alfa-Bank CEO Vladimir Verkhoshinskiy said that “Alfa-Bank engineers have developed their own unique generative AI platform called AlfaGen. This platform makes it possible to connect any cloud LLM, such as GigaChat or YaGPT, to banking processes, as well as quickly integrate neural networks into the bank’s closed system.”

“All interactions with cloud and on-premise neural networks go through a special security module, reliably protecting customer data. Based on AlfaGen, a line of AI assistants for bank employees has been elaborated, which enhances the development speed by 30%,” added the Russian bank’s CEO.

The solution’s unique feature is that it is not just a “smart assistant”, as the AI agents independently develop a complete plan for solving a problem, create a program code, and check the result. These digital assistants, united in teams, can independently create automatic tests for Java programs, just like real developers do, but many times faster.

Virtual employees would analyze a task from project management system, independently write the code for tests, check it for errors, and correct any shortcomings, with no human intervention whatsoever. Automatic tests provide “insurance” against software errors. They check whether the code works correctly under any scenario.

World statistics show that on average, only around 18% of applications are secured by automated tests by over 75%, which is the target level. This can lead to software errors and crashes. Alfa-Bank’s AI solution makes it possible to launch products faster and find 30% more errors. One team of AI agents replaces programmers at work for dozens of hours.

The bank also has customer AI assistants that ask clarifying questions, show empathy, can cheer up and even joke, which makes them indistinguishable from humans. Assistants help the bank customers manage products and finances, record customer requests and accept thanks. Virtual assistants also take into account unique information about each customer and make the employee more knowledgeable and prepared to make the service more personalized and effective.

Russia’s AI leadership on the world stage

Vladimir Verkhoshinskiy has previously acknowledged in media interviews that the development of artificial intelligence is one of the most important advantages of the Russian financial market, allowing it to strengthen its economic position in the global market.

The country’s Central Bank (the banking regulator) also believes that AI allows Russia to strengthen its technological leadership on the global stage, First Deputy Chairman of the Russian Central Bank Vladimir Chistyukhin said at a Russian financial market forum this March. “As for the matters of working with artificial intelligence, the digital ruble, I think that all these technologies will allow us to further consolidate the technological leadership that we have today,” he added.

Governor of the Central Bank of Russia Elvira Nabiullina called against overregulating the industry, allowing new technologies to develop. According to the official, “artificial intelligence is becoming a basic technology” and the Central Bank is looking for the “golden mean” between creating incentives for the development of this technology and protecting citizens from the risks that may arise when using AI.

Another Russian bank, Sber, is also developing AI in the country and has launched its own multimodal neural network model GigaChat, which is also called a competitor to ChatGPT. Sberbank CEO German Gref says that “Artificial intelligence will become the main catalyst for cultural change.”

Not just artificial intelligence

An analysis of fintech innovations in Russia shows that not only AI is widely used here, but also blockchain. For example, Digital Assets (DFA).

These are digital analogues of conventional financial instruments: contracts and securities, such as loans, bonds, shares, futures, etc. With the help of digital financial instruments, it is possible to create products that cannot be issued into circulation on a regular exchange.

For example, “tokenized” rights to square meters or precious metals. The main difference between digital financial instruments and classic securities is that they are fully digitized and issued on the blockchain using smart contracts.

Despite the fact that Russia is not a pioneer in the field of tokenization and transfer of rights into digital format, the very concept of “digital financial instruments” arose here. Digital assets can be analogs of Utility tokens (Utility virtual currencies), Payment tokens / coins (tokens for payment for goods or services) (Utility virtual currencies), CBDC (Central Bank digital currency), Asset-backed tokens (digital analogues of securities / financial instruments), NFT (non-fungible tokens) and other instruments.

The rights under DFA and information about the actions of platform participants are recorded and stored in the blockchain, which essentially replaces the long chains of depositories and agents of the traditional securities market. Some DFA can be tied to indices or secured by real physical assets.

By the way, Alfa-Bank has its own platform of Digital Financial Assets called A-Token. It is a recognized leader in the market in terms of volume and number of DFA issues, and by the number of investors on the platform.

Alfa-Bank has become the first information system operator to make digital financial instruments available to a wide range of investors, including non-qualified investors.

Equivalents of traditional financial instruments in the form of cash claims and fundamentally new investment instruments that had no analogues on the market before were issued on A-Token. In 2024, DFAs for diamonds, DFAs for cinema, DFAs for rental flows, DFAs for residential square meters, DFAs for loans, a cap option in the form of DFA, “Green” DFAs, pledged DFAs, DFAs in currency, DFAs for motivating employees, DFAs with promotional codes for investors, and discount DFAs were launched.

Having delved a little into Russian fintech projects, we can generally conclude that AI and other new technologies are actively used in the work of Russian banks, and these technologies have great prospects.