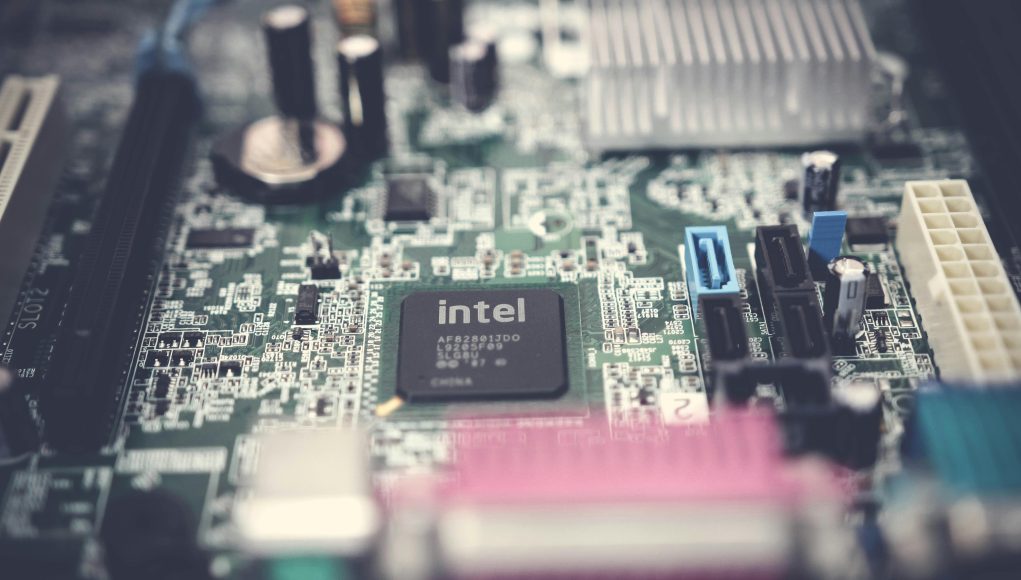

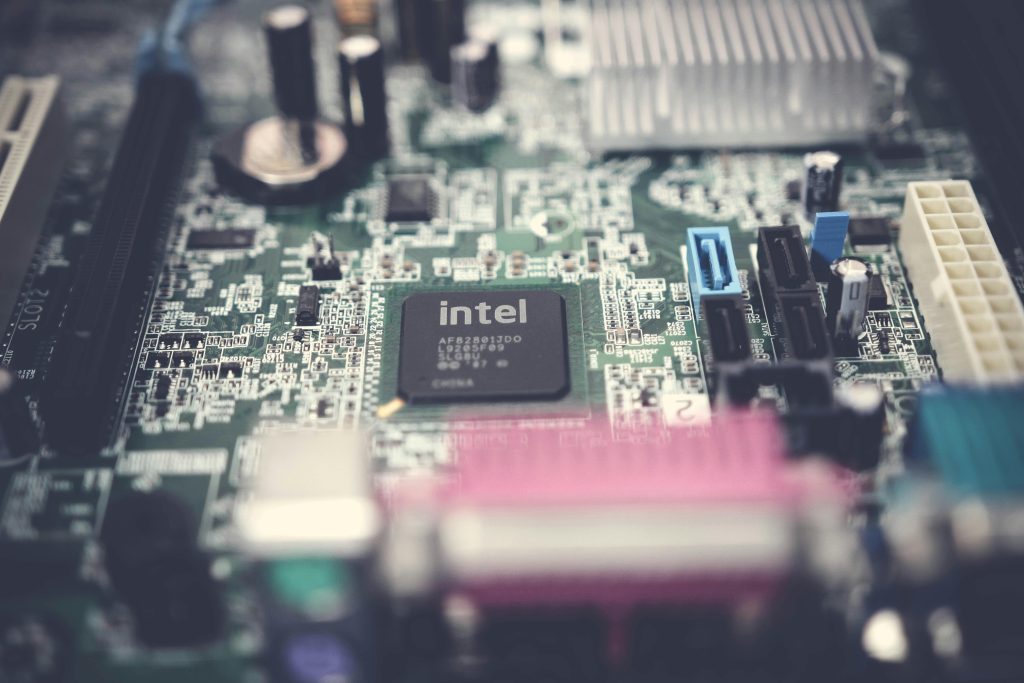

(Singapore, 19.08.2025)It’s been a wild ride for Intel, the once-unquestioned champion of the chip world. After years of struggling to keep pace with rivals and a stock that has seen more downs than ups, the beleaguered semiconductor giant is suddenly at the center of a high-stakes, two-pronged comeback story. In a stunning turn of events, Intel has secured a massive $2 billion investment from a global tech powerhouse and is reportedly in talks for an even bigger cash infusion from the U.S. government.

First, let’s talk about the big-ticket investor: SoftBank. The Japanese technology behemoth, led by the legendary dealmaker Masayoshi Son, has agreed to purchase a whopping $2 billion worth of Intel stock. This isn’t just a simple investment; it’s a huge vote of confidence. Think of it like this: SoftBank, known for its bold and often controversial bets on everything from ride-sharing to AI, is now betting big on Intel’s future.

“For more than 50 years, Intel has been a trusted leader in innovation,” SoftBank’s CEO Masayoshi Son declared in a joint statement. This isn’t just corporate speak. Son has a history of spotting seismic shifts in the tech landscape, and his decision to pour money into Intel signals a deep belief that the chipmaker is on the cusp of a major revival.

The deal, which will see SoftBank pay $23 per share, immediately sent Intel’s stock soaring. For a company that has been battling a narrative of decline, this is a much-needed shot of adrenaline.

But SoftBank isn’t the only one stepping up to the plate. In a move that sounds like something out of a techno-thriller, the Trump administration is reportedly in discussions to take a massive 10% stake in Intel. That’s right, the U.S. government could soon become the chipmaker’s largest shareholder.

The plan involves a creative use of the U.S. Chips and Science Act. Intel has already been slated to receive a colossal $10.9 billion in grants from the Act, designed to boost domestic semiconductor manufacturing. Now, officials are floating the idea of converting some or all of those grants into equity. A 10% stake in Intel is currently worth around $10.5 billion—a figure that lines up almost perfectly with the grant money.

This unprecedented move underscores just how critical Intel’s success is to the national agenda. For years, the U.S. has watched its lead in chip manufacturing slip away to Asia, particularly to powerhouses like Taiwan Semiconductor Manufacturing Co. (TSMC) and Samsung. Both the Trump and Biden administrations have made it a top priority to reverse this trend and bring cutting-edge chip production back home. Having a strong, American-owned chip company like Intel is seen as a matter of economic and national security.

The potential for a government-backed stake in Intel isn’t just about money; it’s about a dramatic change in philosophy. It signals a more aggressive, hands-on approach by Washington in strategic industries. This isn’t an isolated incident either. The government has recently taken a “golden share” in U.S. Steel and a significant equity stake in a rare-earth producer. The message is clear: when it comes to vital sectors, the government is no longer just a spectator—it’s ready to become an active player.

So, what does this all mean for Intel? On one hand, the company is getting a massive influx of capital and powerful allies in SoftBank and the U.S. government. This could provide the financial firepower needed to supercharge its comeback efforts, invest in new technologies, and rebuild its manufacturing prowess. New CEO Lip-Bu Tan, who took the helm earlier this year, has his work cut out for him, but he now has two of the world’s heaviest hitters in his corner.

The road ahead is far from easy. Intel has been struggling with stagnant sales and continuing losses. Its new strategy has largely focused on cost-cutting and job eliminations. Investors, while initially excited by the news, remain cautious. The stock, after an initial rally, has seen some volatility. The big question looming over everything is whether this fresh capital will truly help Intel regain its technological edge and once again become a leader, not just a survivor.

After years of facing intense scrutiny and doubt, this week marks a profound turning point for Intel. With billions in backing from SoftBank and the potential for a massive government investment, the company is no longer just fighting to stay relevant. It’s now at the heart of a global story about technological revival, national security, and the future of the digital world. The once-sleepy chipmaker has transformed into a symbol of America’s ambition to reclaim its place at the top of the tech food chain. It’s a high-stakes drama playing out in real-time, and everyone is watching to see if Intel can truly get its chips in a row.