(Singapore, May 11, 2020) More than 60% of the SMEs in Singapore would have entered the current crisis with lower credit ratings, an Experian’s study of more than 50,000 Singapore SMEs across 12 sectors has revealed.

The study was analyzed through the Experian Ascend: Analytics on Demand platform, and was complemented by Experian’s debt payment analysis generated through its Non-Bank Credit Bureau.

“A strategic approach to minimize the negative impact on the Singapore economy is to leverage analytics capabilities for actionable insights. This will facilitate the accurate identification of specific sub-segments and companies that may require closer intervention along the evolving stages of the current economy, accelerating its recovery,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

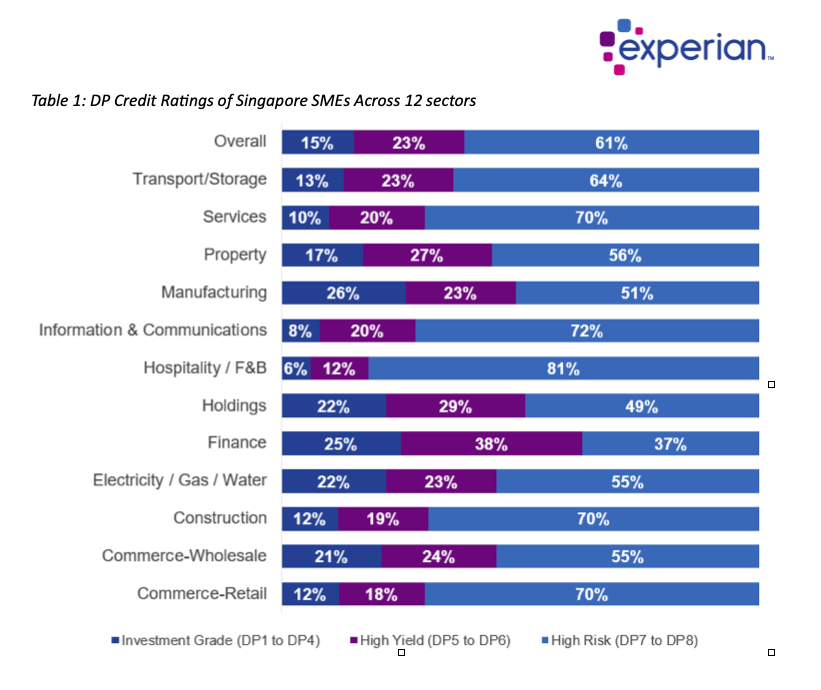

Based on the analysis from the latest financial statements of over 50,000 SMEs, Experian found that 61 percent of the SMEs analyzed would have entered the current crisis with lower credit ratings of DP7-DP8 — which indicates the highest probability of default.

Such ‘high risk’ SMEs would have had existing access to capital challenges with lenders, given lacklustre trading conditions in 2019 and the companies’ weaker credit profiles.

A majority of Singapore SMEs were already experiencing ‘high risk’ credit ratings positions entering 2020, likely caused by business challenges exacerbated by the US-China trade war, a depressed manufacturing output and weak discretionary consumer spending in 2019. Among the sectors with weaker DP Credit Ratings are Hospitality/F&B (81%), Information & Communications (72%), Commerce-Retail (70%), Construction (70%) and Services (70%).

In addition to credit ratings, Experian also analysed the SMEs’ near time financial strength, with short term cash flow and debt exposure a concern for most SMEs. While overall working capital remained positive, organisations in Commerce-Retail, Construction, Hospitality/F&B, and Property appear to be experiencing challenges related to cash flow.

Seven out of 12 sectors surveyed registered negative Profit Margins, resulting in an overall negative reading. Such negative profit margins were of concern especially for sectors comprising of younger SMEs where their ability to generate returns over time were comparatively weaker.

The impact has been the most pronounced for SMEs in the Commerce-Retail, Construction, Manufacturing, and Hospitality/F&B sectors. While micro SMEs (organizations with a turnover of less than S$1M) usually hold weaker financial positions due to thinner profit margins, their larger counterparts (organizations with a turnover of S$1M to S$10M) were observed to also be struggling with negative margins.

Underscoring the severity of the economic fallout stemming from the pandemic, figures from the Ministry of Trade and Industry (MTI) indicated that Singapore’s GDP had contracted by 2.2 percent in 1Q20. With no clear end to the global pandemic on the horizon, MTI had also downgraded the city state’s growth forecast for 2020 to -4 to -1 percent.

The Hospitality/F&B, Retail, and Construction sectors were noticeable as high risk across nearly all measurements, suggesting that they may continue to face significant challenges in the immediate term. SMEs in F&B and Retail registered one of the lowest levels of business optimism in the SBF-Experian SME Index released in April 2020, having weathered the brunt of travel and movement restrictions implemented in the wake of the COVID-19 outbreak which has impacted sales.

Construction projects are likely to experience delays due to the mandatory Stay Home Notices issued to all foreign workers in the sector. Any delays in project delivery and completion can impact cash flow projection among Construction SMEs, eroding confidence in the sector.