Bond yields have soared. But their appeal depends on which part of the market you’re looking at.

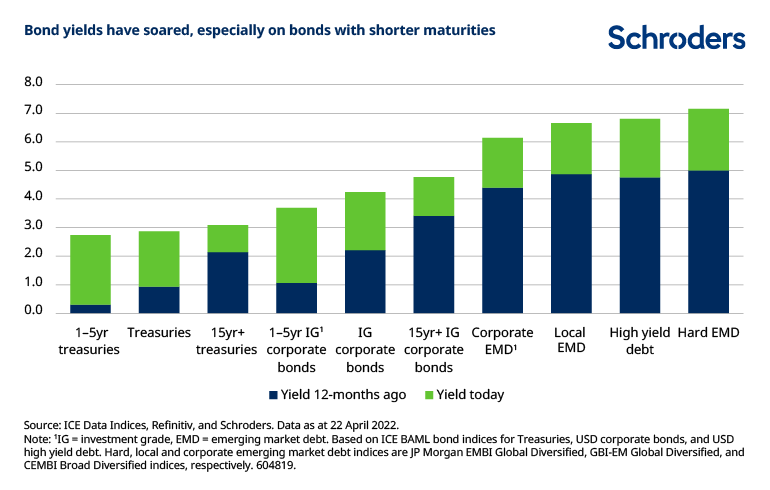

Government bond yields have soared, and the effects have reverberated through the rest of the fixed income market. But how much yields have risen depends on which part you’re looking at.

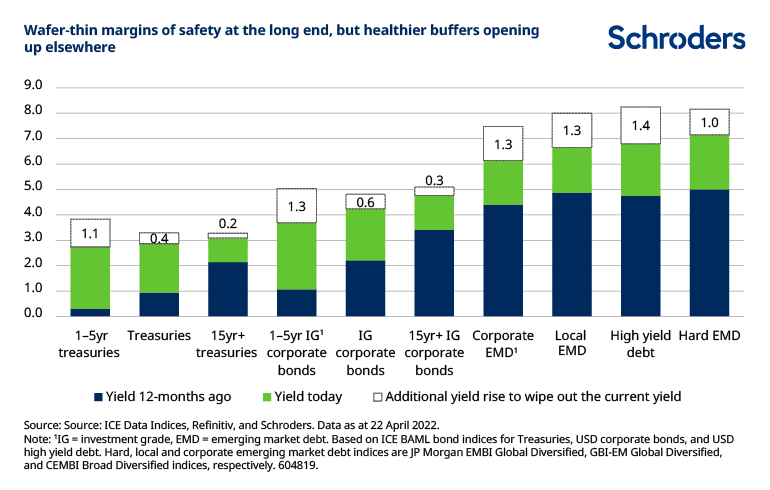

And only a tiny extra rise in longer-dated yields would leave investors nursing losses, thanks to important changes in the structure of the bond market. Despite higher yields, their cushion against losses is still wafer-thin. But relative value opportunities may be cropping up elsewhere.

A sharp rises in yields

This time last year, short-dated US Treasuries yielded only 0.1%. Today they yield 2.7%, as the market has priced in a series of aggressive interest rate hikes from the Federal Reserve. Longer-dated yields have also risen, but not by as much, from 2.1% to 3.1%. These figures are for 1-5 year maturity bonds and over-15 year maturity bonds, respectively.

With credit spreads also rising, corporate bond yields have risen by even more than their government counterparts. And yields on emerging market debt (hard currency, local currency, and corporate) have all risen too.

But be wary of increased sensitivity to movement in yields

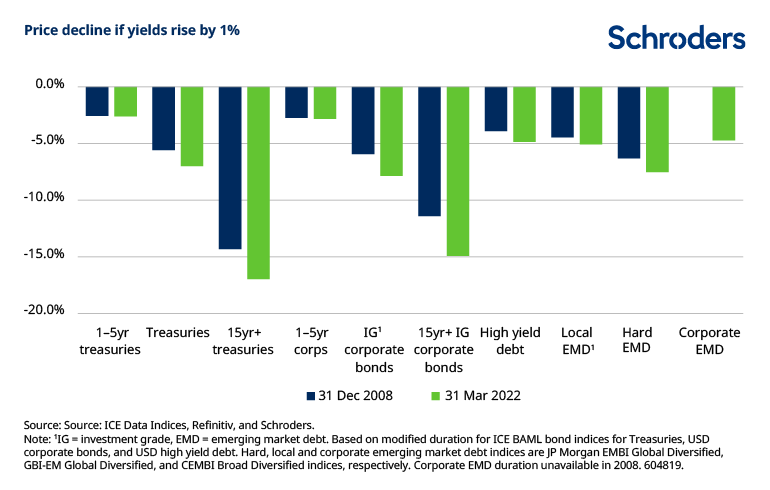

One of the most important trends in bond markets over recent decades has been the increased sensitivity of prices to movements in yields. In 2008, if the entire Treasury yield curve shifted up by 1%, investors in the broad Treasury market would see the value of those investments fall by around 5.6%. Today that figure would be 7.0%.

This is most troubling for investors in longer-dated bonds, whose prices are more sensitive to movements in yields. And which have become even more so.

It’s important to note that this sensitivity cuts both ways. Longer-dated bonds would experience a larger price gain, than other bonds and than in the past, if yields were to fall from here.

Margin of safety

Although yields have picked up, they are still low. When coupled with bonds’ greater sensitivity to yield movements, it would only take a small further rise in yields to leave many investors sitting on losses. This is particularly the case for longer-dated bonds. A 0.2% rise in long-dated Treasury yields or a 0.3% rise in long-dated corporate bond yields is all it would take.

But the steep rise in shorter-dated yields make them now an interesting proposition. Their yields have risen by more, and there is now very little difference between short- and long-dated Treasuries.

The market is now also aggressively pricing in a more than 70% chance that the Federal Reserve hikes interest rates by at least 2.5% by the end of 2022. If this fails to happen, yields on more policy-sensitive short-dated bonds could fall, boosting their prices.

And, on the other side of the equation, yields would have to rise by quite a lot more to result in investors losing money. Relative to both long-dated bonds and cash, the investment case for short-dated bonds has improved a lot.

Longer-dated corporate bonds continue to have a bit more of an advantage over shorter-dated ones, but that has narrowed considerably. And, at current levels, shorter-dated bonds can also stomach a much larger rise in yields before being vulnerable to losses. As can high yield and emerging market debt – although they come with additional credit and currency risks.

Many people buy long-dated bonds for reasons other than return; for example pension funds and insurance companies managing their liability risks, and investors hoping they will perform well if equities sell off. However, for those who are more return-motivated, and that are prepared to take a more flexible approach, opportunities are opening up elsewhere.