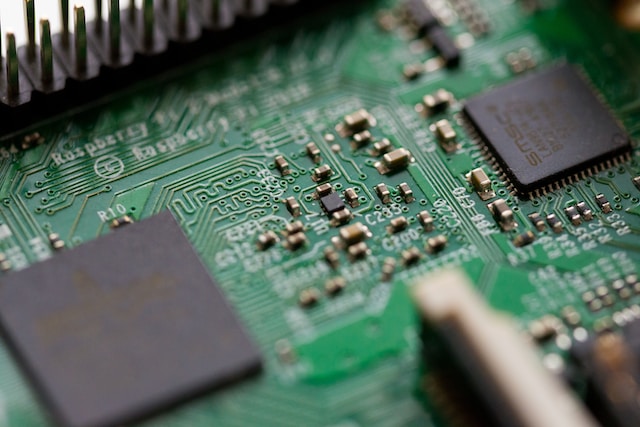

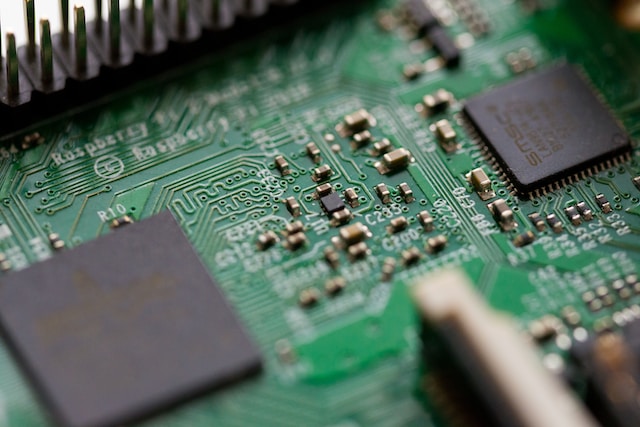

(Singapore August 1, 2023)China’s tech sector is showing the strain from last year’s sweeping US export restrictions, which seek to stall Beijing’s ambitions in cutting-edge industries such as artificial intelligence and supercomputing, the Wall Street Journal has reported.

According to the WSJ report, Chinese companies say they are struggling to get key components and machinery. And chipsets that have been remodeled to make them less powerful so they fall within US rules are now threatened by the possibility of additional restrictions.

The distress signals show Washington’s nine-month-old policy of denying Beijing access to the most advanced semiconductors and the tools to make them is starting to bite, despite loopholes and workarounds keeping some key components flowing, the report said.

The restrictions also show the obstacles facing China in developing domestic alternatives for some of the most sought-after foreign semiconductor technologies.

“The controls appear to be making it harder and costlier for China to gain certain inputs,” said Emily Benson, a senior fellow specializing in trade and technology at the Center for Strategic and International Studies think tank, as quoted by WSJ.

China’s recent customs data show that imports of semiconductors fell by 22% in value terms during the first six months of 2023 from a year earlier. Imports of chip-manufacturing equipment dropped by 23%, extending last year’s decline.

Leading chip-manufacturing regions accounted for the lion’s share of the decline in semiconductor imports. Taiwan, home to Taiwan Semiconductor Manufacturing Co., the world’s largest chip maker, accounted for about 40% of the drop in China’s chip imports during the first five months of the year. South Korea, home to Samsung, SK Hynix and other chip giants, accounted for almost one-third. The U.S. restrictions affect foreign companies that use U.S. chip-making tools—which virtually all of them do.

Japan on July 23 restricted the export of crucial semiconductor-manufacturing equipment, following curbs announced by the Netherlands. The two countries, together with the US, are the only makers of some machinery essential to manufacturing the most advanced chips, the report said.

Unable to access the latest chips, China’s AI contenders risk falling behind in a sector that Beijing has said it aims to lead the world in by 2030. UBS said it expects global demand for AI products to reach $300 billion by 2027, from $28 billion last year. Meanwhile, US tech giants including Microsoft, Google and Amazon are pumping billions into AI platforms unhindered, the WSJ report said.

The U.S. export rules announced Oct. 7 included caps on the power of certain processors used in AI applications and in supercomputers, as well as restrictions on the types of chip-making machinery, components and software China can import.

China has taken retaliatory actions. On July 3, China said it would restrict exports of gallium, used in some advanced semiconductors. More recently, China’s ambassador to the U.S., Xie Feng, threatened further retaliatory action, saying that Beijing “won’t flinch from any provocation.”