(Singapore, September 17, 2019) The single European currency poses a bigger threat to the global trading system than China does, Stewart Paterson, a research fellow at the Hinrich Foundation, said today in Singapore.

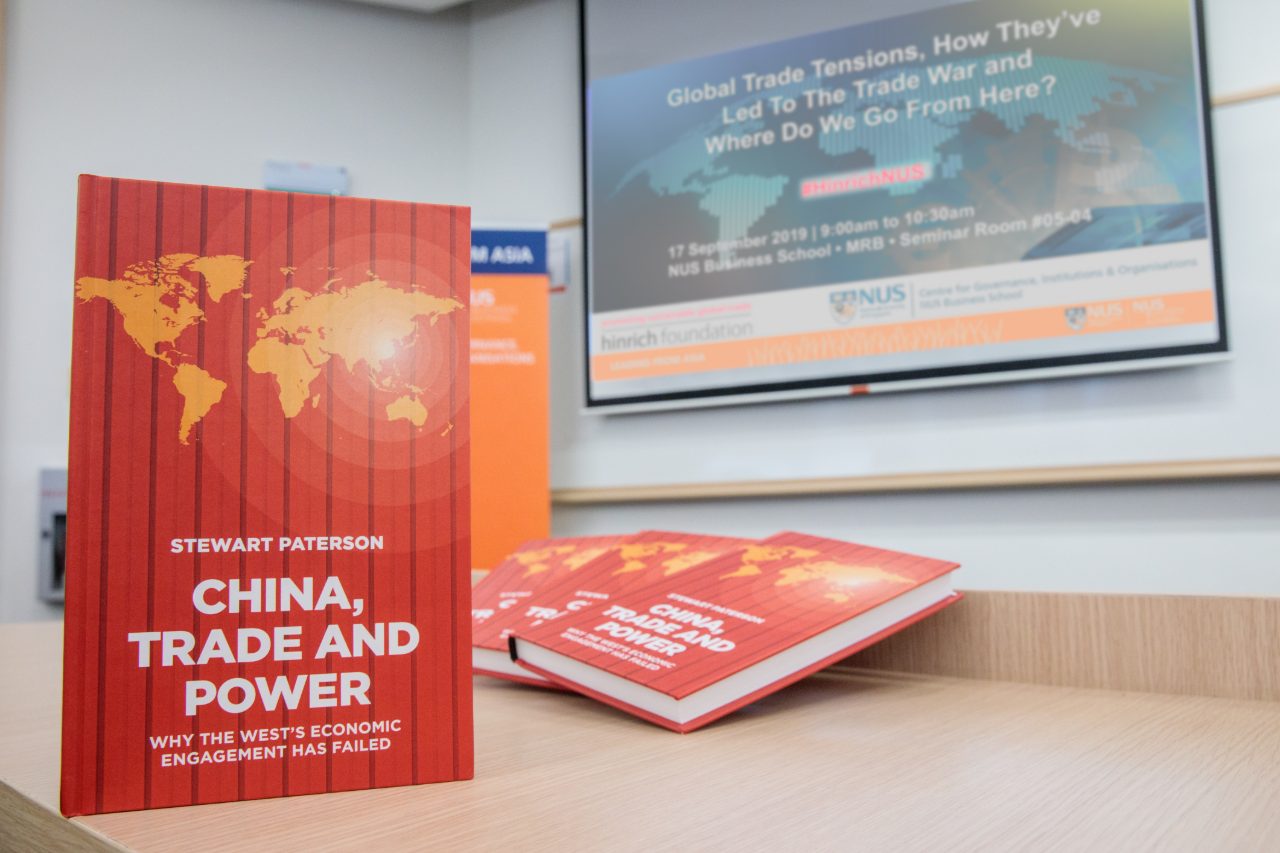

He made the remarks during a global trade tension seminar at the National University of Singapore Business School. The Hinrich Foundation is based in Hong Kong with a focus on promoting sustainable global trade.

“The US-EU trade relationship is about twice as important as the US-China one in terms of monetary size,” said Paterson, who is also the author of “China, Trade and Power: Why the West’s Economic Engagement Has Failed“.

He said at NUS that Germany’s current account surplus has been about seven percent of its GDP on average over the last five years.

“Germany’s trade surplus is bigger than China’s despite the fact that the German economy is the third largest,” he said, noting that that might trigger another trade war, but the US would probably find it an overreach.

Recent reports show that Germany is expected to run the world’s largest current account surplus this year for the fourth consecutive year, with Japan and China as the second and third runner-ups.

A country’s current account surplus measures its flow of goods, services, and investments.

Germany’s current account surplus is widely believed to be attributed to the fact that far more German products and services are sold overseas than imported to Europe’s largest economy.

That has stirred the wrath of US President Donald Trump, who has threatened to impose additional tariffs on German carmakers. The EU and IMF have also reportedly criticized the trade imbalance.

Paterson said that Germany has gained an advantage from the single European currency. He predicted that facing the trade tension between the US and China, the Europeans will come into line with the Americans.

“It’s in Europe’s best interests to disengage China in the same way as the US does… It’s not just the American companies who feel that their IP (intellectual properties) have been copied and stolen. There have been German companies as well,” Paterson said.

“Trump didn’t go down the root of trying to put together an alliance against China in the early part of the trade war because he didn’t trust his allies to toe the line,” he explained.

“Trump’s aims are very much compatible with the US national interests,” said Paterson. But he added that there has never been a successful trading relationship between competing ideologies.

Paterson has been following the Chinese economy since 1991. After a stint in London and Mumbai, he lived in Hong Kong from 1998 to 2007 during which he worked for CLSA and then Credit Suisse. He moved to Singapore in 2007 and now lives in the UK.