(Singapore, Mar 30, 2020) Corporate defaults could rise beyond 20% as the coronavirus pandemic unleashes economic and financial turmoil around the world, a Moody’s Investors Service report has revealed today.

The US business and financial services company finds that the global default rate would climb to 6.8% in one year in a sharp but short downturn, and to 16.1% under conditions similar to the global financial crisis.

In February 2020, the speculative-grade default rate was 3.1%. In a scenario in which a sharp contraction in the first half of this year turns into a recovery late in the year, the speculative-grade default rate for nonfinancial and financial companies would climb to 6.8% over the next twelve months.

If, however, economic and financial conditions were to weaken much more, and turn similar to those during the global financial crisis, the default rate would jump to 16.1% in a year. In an extremely severe recession, worse than the last crisis, it would rise to 20.8%.

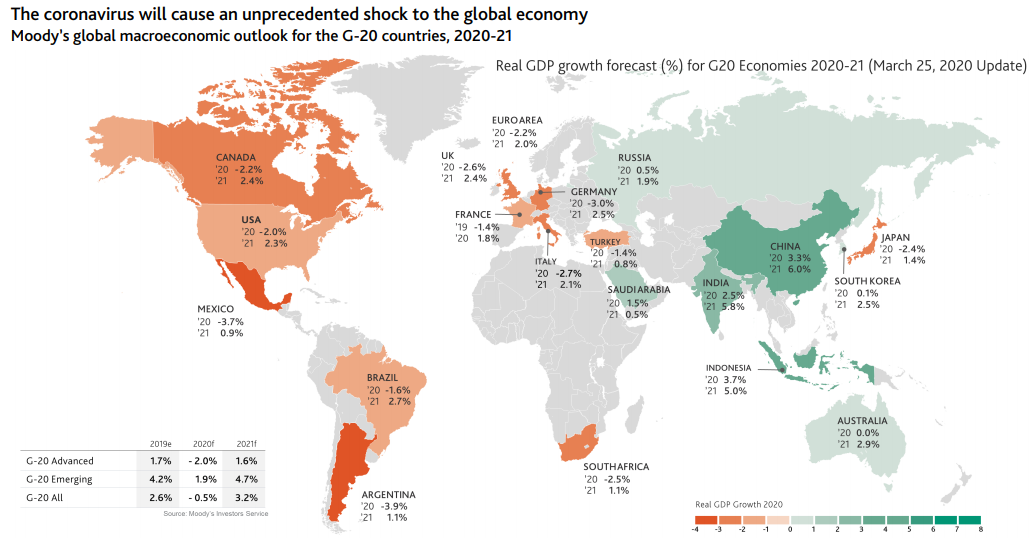

Also in the report, the coronavirus pandemic and restrictions implemented to limit contagion have led to severe economic and financial stress around the world.

Also in the report, the coronavirus pandemic and restrictions implemented to limit contagion have led to severe economic and financial stress around the world.

“We expect overall GDP growth in G20 economies to fall by 0.5% this year, reflecting significant economic shocks in all G20 economies,” the report says.

Membership of the G20 consists of 19 individual countries plus the European Union. Singapore is not a member of G20.

Collectively, the G20 economies account for around 90% of the gross world product (GWP), 80% of world trade (or, if excluding EU intra-trade, 75%), two-thirds of the world population, and approximately half of the world land area.