(Singapore, 9 October 2020) “Digitalisation” has become the latest buzzword in the 21st century. Increasingly, many more economies are riding on the wave of digital transformation, to drive innovative solutions and achieve business efficiency. Technology is deepening financial inclusion throughout emerging markets in Africa, Latin American, and Asia, however, there remains a need to strike a balance between cyber risks and greater adoption of digital technology, Moody’s Investors Service said in a report released on 8th October.

Growing embracement of digital technologies has enabled companies to expand their outreach to the emerging markets. Fintech firms and banks are using these technologies to offer services that were either unavailable or too costly for most people in emerging markets.

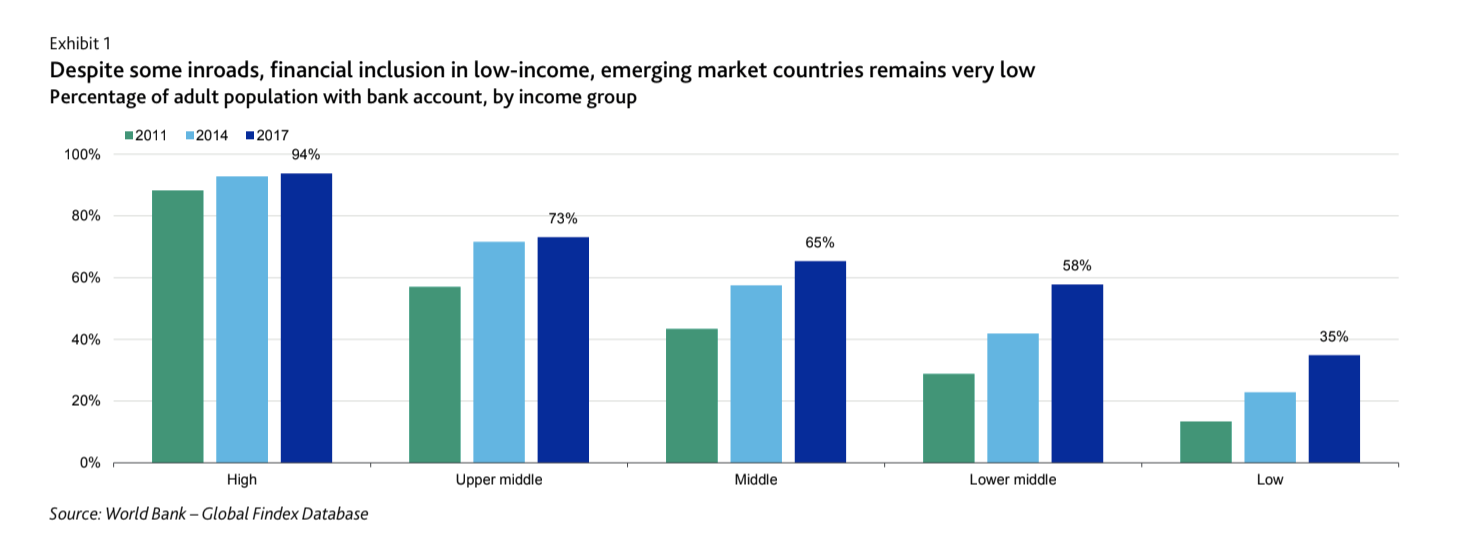

According to the report, numerous countries remain severely underbanked despite significant progress in recent years. In fact, the percentage of adults with a bank account in low-income and lower middle-income countries was 35% and 58% respectively as of 2017. This contrast is more obvious when compared to a level of 94% in high-income countries.

In this environment, new solutions brought by fintech firms, as well as by new internet-only banks are able to address the constraints that barred some sections of society from access to credit. Not only it could lead to greater accessibility to credit, new technological solutions could also lower the cost of financial transactions by 80%-90%, with digital finance unlocking $2.1 trillion of new credit to small and microbusinesses.

On top of that, the use of biometrics such as fingerprints, iris scans and facial images has allowed those people without documents to open bank accounts, as the use of biometrics could address identification issues. The increasing adoption of electronic payments via smartphone applications increases the efficiency of money flows. Electronic payment systems have enabled technology firms to leapfrog traditional banks and better cover excluded sections of society, such as rural populations, farmers and women.

Asia has seen the largest increase in consumer digital payments. The report points to the example of China, whereby Alibaba Group Holding Limited and Tencent Holdings Limited drove the expansion of digital retail payments by offering a cheaper, convenient alternative to cash and card-based payment systems.

In the report released, Moody’s highlighted how data analytics and Artificial Intelligence (AI) are delivering innovative credit solutions when previously, lack of credit history has constrained dispersement in emerging markets.

Widening use of mobile phones by low-income populations in emerging markets means that data could be collected through mobile phones which allows for analysis and evaluation of consumption patterns and social media information. Such analysis could be used to further develop individual credit scores using algorithms, allowing quick credit decisions by financial intermediaries. For example, financial intermediaries such as banks could derive the credit position of a customer through analysing his frequency of online purchases and bill payments.

The report also emphasised how new technologies such as blockchain and cloud-based hosting services could support the development of new affordable products. In particular, Distributed Ledger Technology (DLT) such as blockchain is able to reduce the transaction cost of cross-border payments, remittances and trade finance. Similarly, cloud-based hosting services provide Information Technology (IT) services via a network of remote servers accessed over the internet. Operating on the cloud drives down costs, allowing cheaper financial services.

From buzzword to value creation, mobile and digital technology, Artificial Intelligence (AI) and Blockchain has indeed deepened financial inclusions across emerging markets. However, Moody’s warned against cyber risks associated with greater adoption of such varied forms of new technologies. In particular, increased digitalization and connectivity exposes operators and consumers to cyber risks, requiring more active and more costly risk management. As requirements for data privacy are less developed, potential misuse of consumer data by fintech firms is another concern to be addressed.

“Both credit risk and cyber risk are on the rise, so a robust and vigilant regulatory framework will be key to the successful deployment of these new technologies,” says Constantinos Kypreos, Senior Vice President at Moody’s Investors Service.