The Q4 of 2018 saw a deterioration in local firms’ payment performance for the third consecutive quarter, the Singapore Commercial Credit Bureau (SCCB) announced today.

SCCB says prompt payments weakened further to nearly two-fifths of total payment transactions while slow payments also accounted for more than one-third of total payment transactions.

On a quarter-on-quarter (q-o-q) basis, prompt payments fell by 4.48 percentage points from 48.31 percent in Q3 2018 to 43.83 percent in Q4 2018.

Year-on-year (Y-o-y), prompt payments dropped visibly by 6.57 percentage points from 50.40 percent in Q4 2017 to 43.83 percent in Q4 2018.

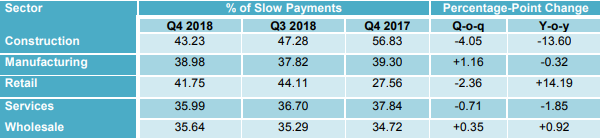

Among the industries, the manufacturing sector saw further deterioration in slow payments owing to an increase in payment delays by manufacturers of petroleum and coal products, machinery and apparels.

Payment delays within the wholesale sector also deteriorated due to an increase in payment delays within the wholesale trade of durable goods.

Some analysts have partially contributed the delayed payment to the trade tensions between the US and China.

However, slow payments within the construction sector improved for the fourth consecutive quarter in Q4 2018. Services and retail sectors have only experienced slight changes.

Prompt payment refers to when 90 percent or more of total bills are paid within the agreed payment terms, while slow payment is defined as when less than 50 percent of total bills are paid within the agreed terms. Partial payment refers to when between 50 and 90 percent of total bills are paid within the agreed payment terms.

D&B Singapore compiles the figures by monitoring more than 1.6 million payment transactions of firms operating through its Singapore Commercial Credit Bureau (SCCB). Payment data is contributed by local firms.