Russia’s invasion of Ukraine, which is having devastating human consequences, has increased the risk of a stagflation environment – one of slowing economic growth but high inflation.

How should investors prepare for this possible scenario? Our analysis reveals which asset classes are likely to outperform if it comes to pass.

In general, there are four different phases of the business cycle based on the evolution of output: recovery, expansion, slowdown and recession.

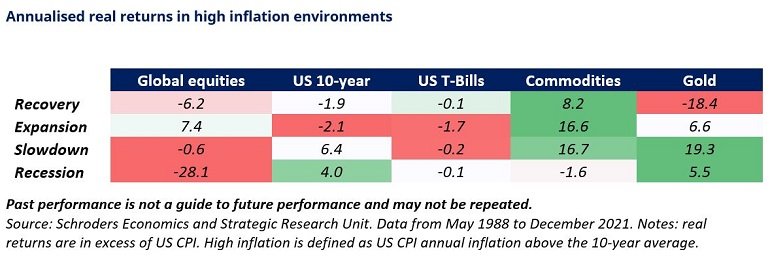

The table below shows the average real (inflation-adjusted) total return of major asset classes for each business cycle phase during high inflation environments.

Historically, the slowdown phase has favoured investing in traditional inflation-hedges such as gold (+19.3%) and commodities (+16.7%).

This makes economic sense. Gold is often seen as a safe-haven asset and so tends to appreciate in times of economic uncertainty.

Commodities, such as raw materials and oil, are a source of input costs for companies as well as a key component of inflation indices. So, they will typically perform well when inflation rises too (often because they are the cause of the rise in inflation).

In comparison, the slowdown phase has proved very challenging for equities (-0.6%), as companies combat falling revenues and rising costs.

Keeping your savings in cash (-0.2%), proxied via T-Bills, hasn’t been a better strategy.

Although US Treasury bonds have performed well in the past (+6.4%), they should be treated with caution today.

In theory, they should benefit from falling real rates, driven by declining growth.

However, rising inflation eats into their income, putting upward pressure on yields and downward pressure on prices.

In practice, the extent to which this harms bond returns will depend on their duration and starting yield (higher yields provide a larger cushion to absorb rate rises).

What has changed? What are the key takeaways for asset allocation?

Last year, the reflation environment favoured investing in risk assets such as equities and commodities, while gold has suffered.

This is consistent with what we would expect using our previous analysis. However, if we are on the cusp of a period of stagflation, then a shift in performance leadership may be on the way.

In this scenario, equity returns may become more muted while gold and commodities may outperform. This is exactly what has manifested so far in 2022.

Meanwhile, central banks are stuck between a rock and a hard place. Hiking interest rates too quickly could send the global economy into recession. But keeping rates low for too long could send inflation spiralling out of control.

Taken together, the outcome for bonds is uncertain and will depend on the tug-of-war between inflation and growth sentiment.